Question: 36. LO.5, 9 Quinn Corporation is subject to tax in States G, H, and I. Quinns compensation expense includes the following: Officers salaries are included

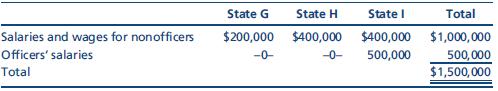

36. LO.5, 9 Quinn Corporation is subject to tax in States G, H, and I. Quinn’s compensation expense includes the following:

Officers’ salaries are included in the payroll factor for G and I, but not for H. Compute Quinn’s payroll factors for G, H, and I. Comment on your results.

State G State H State I Total Salaries and wages for nonofficers $200,000 $400,000 $400,000 $1,000,000 Officers' salaries -0- -0- 500,000 500,000 Total $1,500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts