Akkadian Capital, a real estate investment firm, owns five apartment buildings around a four-year college campus. The

Question:

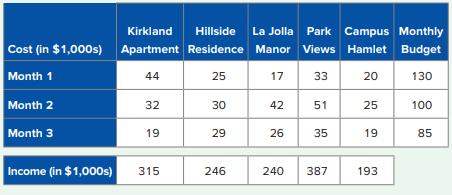

Akkadian Capital, a real estate investment firm, owns five apartment buildings around a four-year college campus. The five buildings need significant repairs and renovation, and each renovation project will take about three months to complete. The company expects each renovated apartment building to generate a substantial rental income from college students. However, Akkadian Capital has a limited budget during the next three months and cannot repair and remodel all five buildings. The remodeling cost and the expected annual income after expenses from each apartment are shown in the following table. Also included in the table is Akkadian’s budget for the next three months.

a. Formulate and solve an IP model to help Akkadian determine which apartment buildings to renovate in order to maximize its rental income, while staying within its budget. What is the maximum amount of rental income that Akkadian can generate?

b. Which apartment buildings should Akkadian remodel? Why?

c. Will Akkadian use up all of its budget in each month?

Step by Step Answer:

Business Analytics Communicating With Numbers

ISBN: 9781260785005

1st Edition

Authors: Sanjiv Jaggia, Alison Kelly, Kevin Lertwachara, Leida Chen