Credit card fraud is becoming a serious problem for the financial industry and can pose a considerable

Question:

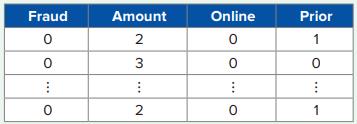

Credit card fraud is becoming a serious problem for the financial industry and can pose a considerable cost to banks, credit card issuers, and consumers. Fraud detection using data mining techniques has become an indispensable tool for banks and credit card companies to combat fraudulent transactions. A sample credit card data set contains the following variables: Fraud (1 if fraudulent activities, 0 otherwise), Amount (1 if low, 2 if medium, 3 if high), Online (1 if online transactions, 0 otherwise), and Prior (1 if products that the card holder previously purchased, 0 otherwise). A portion of the data set is shown in the accompanying table.

a. Partition the data to develop a naïve Bayes classification model. Report the accuracy, sensitivity, specificity, and precision rates for the validation data set.

b. Generate the decile-wise lift chart. What is the lift value of the leftmost bar? What does this value imply?

c. Generate the ROC curve. What is the area under the ROC curve (or AUC value)?

d. Interpret the performance measures and evaluate the effectiveness of the naïve Bayes model.

e. Change the cutoff value to 0.1. Report the accuracy, sensitivity, specificity, and precision rates for the validation data set.

Step by Step Answer:

Business Analytics Communicating With Numbers

ISBN: 9781260785005

1st Edition

Authors: Sanjiv Jaggia, Alison Kelly, Kevin Lertwachara, Leida Chen