George believes that the returns of mutual funds are influenced by annual turnover rates and annual expense

Question:

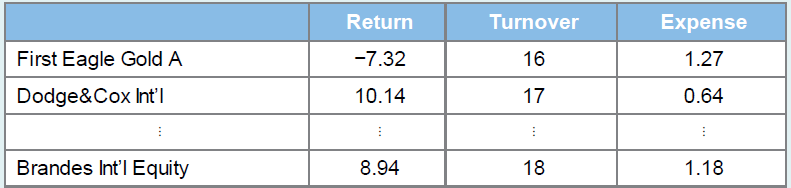

George believes that the returns of mutual funds are influenced by annual turnover rates and annual expense ratios. In order to substantiate his claim, he randomly selects 20 mutual funds and collects data on each fund’s five-year annual return (Return), its annual holding turnover rate (Turnover), and its annual expense ratio (Expense). All variables are measured in percentages. A portion of the data is shown in the accompanying table.

a. Estimate: Return = β0 + β1 Turnover + β2 Expense + ϵ. Conduct appropriate tests to verify George’s theory at the 5% significance level.

b. Discuss the potential problems of multicollinearity and changing variability.

Mutual FundsMutual funds are like a pool of funds gathered by different small investors that have simalar investment perspective about returns on their investments. These funds are managed by professional investment managers who act smartly on behalf of the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Business Statistics Communicating With Numbers

ISBN: 9781259957611

3rd Edition

Authors: Sanjiv Jaggia

Question Posted: