In a report, use the above information to 1. Calculate descriptive statistics to compare the returns of

Question:

In a report, use the above information to

1. Calculate descriptive statistics to compare the returns of the mutual funds.

2. Assess reward by constructing and interpreting 95% confidence intervals for the population mean return. What assumption did you make for the interval estimates?

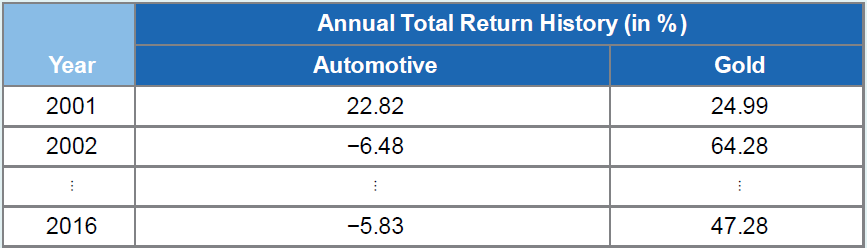

The following table presents a portion of the annual returns for two mutual funds offered by the investment giant Fidelity. The Fidelity Select Automotive Fund invests primarily in companies engaged in the manufacturing, marketing, or sales of automobiles, trucks, specialty vehicles, parts, tires, and related services. The Fidelity Gold Fund invests primarily in companies engaged in exploration, mining, processing, or dealing in gold and, to a lesser degree, in other precious metals and minerals.

Annual Total Return (%) History

Mutual funds are like a pool of funds gathered by different small investors that have simalar investment perspective about returns on their investments. These funds are managed by professional investment managers who act smartly on behalf of the...

Step by Step Answer:

Business Statistics Communicating With Numbers

ISBN: 9781259957611

3rd Edition

Authors: Sanjiv Jaggia