Question: Shown here is a decision table. A forecast can be purchased by the decision-maker. The forecaster is not correct 100% of the time. Also given

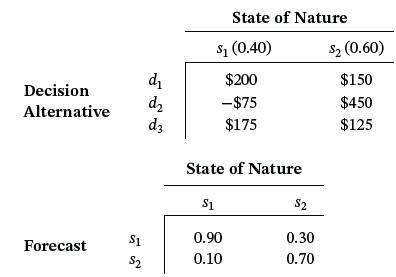

Shown here is a decision table. A forecast can be purchased by the decision-maker. The forecaster is not correct 100% of the time. Also given is a table containing the probabilities of the forecaster being correct under different states of nature. Use the first table to compute the EMV of this decision without sample information. Use the second table to revise the prior probabilities of the various decision alternatives. From this and the first table, compute the EMV with sample information. Construct a decision tree to represent the options, the payoffs, and the expected monetary values. Calculate the value of sample information.

Decision Alternative Forecast $1 $2 d d d3 State of Nature $ (0.40) $200 -$75 $175 State of Nature $1 0.90 0.10 $2 0.30 0.70 $ (0.60) $150 $450 $125

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

The Expected Value With Sample Information is 28500 Va... View full answer

Get step-by-step solutions from verified subject matter experts