A small Canadian mining company is issuing an initial public offering (IPO) of shares on the Vancouver

Question:

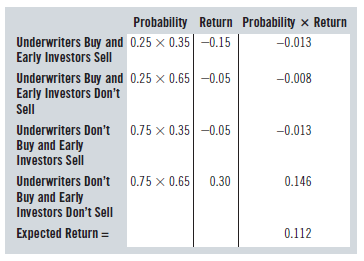

A small Canadian mining company is issuing an initial public offering (IPO) of shares on the Vancouver Stock Exchange at $17 per share. A limited number of “early” investors were able to purchase these shares at $17 on the IPO date, and the shares were traded on the stock exchange for any member of the public to buy/sell the day after. During the first few weeks of public trading the underwriters may purchase shares if they think the price is dropping too low, and the investors who bought shares the day before at the IPO price of $17 may sell if the price rises above $17 and they want to make a quick profit. You’re considering purchasing shares at the start of the first day of public trading and have a target of making a capital gain of 10% in the first year. You ask the advice of a stockbroker about whether you can make a 10% capital gain. “If the underwriters have to buy to prop up the price, that’s a bad sign,” says the broker. “If a significant number of early investors sell off their shares, that’s a bad sign too. In either of those cases you’ll have a loss of about 5% in the first year. If both those things happen, you’ll have a loss of about 15% in the first year. Looking at similar recent IPOs, the chances of those things happening are about 0.25 and 0.35, respectively. If neither of these happens, you could easily make 30% in the first year.” “Okay,” you say, “but should I buy?” The stockbroker crunches the numbers for buying:

“The expected return from buying is 11.2% and your target was 10%, so you should buy,” replies your broker. Comment on the ethics of the stockbroker’s advice in relation to the ASA Ethical Guidelines in Appendix C.

Step by Step Answer:

Business Statistics

ISBN: 9780133899122

3rd Canadian Edition

Authors: Norean D. Sharpe, Richard D. De Veaux, Paul F. Velleman, David Wright