Carry out a posterior analysis of the investors decision problem. That is, determine the investment choice that

Question:

a. The economist says €œmarket up.€

b. The economist says €œmarket flat.€

c. The economist says €œmarket down.€

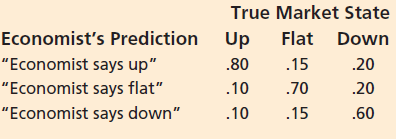

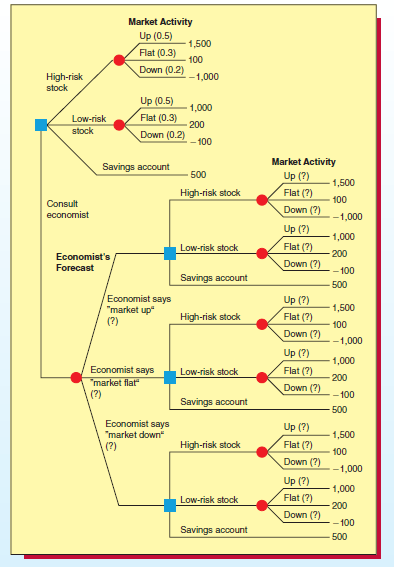

An Introduction to Decision Analysis, 2nd ed., Robert T. Clemen presents an example in which an investor wishes to choose between investing money in (1) a high-risk stock, (2) a low-risk stock, or (3) a savings account. The payoffs received from the two stocks will depend on the behavior of the stock market€”that is, whether the market goes up, stays the same, or goes down over the investment period. In addition, in order to obtain more information about the market behavior that might be anticipated during the investment period, the investor can hire an economist as a consultant who will predict the future market behavior. The results of the consultation will be one of the following three possibilities: (1) €œeconomist says up,€ (2) €œeconomist says flat€ (the same), or (3) €œeconomist says down.€ The conditional probabilities that express the ability of the economist to accurately forecast market behavior are given in the following table:

For instance, using this table we see that P(€œeconomist says up€ u market up) 5 .80. Figure 18.7 on the next page gives an incomplete decision tree for the investor€™s situation. Notice that this decision tree gives all relevant payoffs and also gives the prior probabilities of up, flat, and down, which are, respectively, 0.5, 0.3, and 0.2.

Figure 18.7

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Step by Step Answer:

Business Statistics In Practice Using Data Modeling And Analytics

ISBN: 9781259549465

8th Edition

Authors: Bruce L Bowerman, Richard T O'Connell, Emilly S. Murphree