Investment style plays a role in constructing a mutual fund. Many individual stocks can be grouped into

Question:

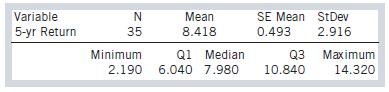

Investment style plays a role in constructing a mutual fund. Many individual stocks can be grouped into two distinct categories: growth and value. A growth stock is one with high earning potential and often pays little or no dividends to shareholders. Conversely, value stocks are commonly viewed as steady or more conservative stocks with a lower earning potential. A family is trying to decide what type of funds to invest in. An independent advisor claims that value mutual funds provided an annualized return of greater than 8% over a recent five-year period. Below are the summary statistics for the five-year return for a random sample of such value funds:

Test the hypothesis that the mean five-year return for value funds is greater than 8%, assuming a significance level of 5%. What does this evidence say about the independent advisor’s claim that the annualized five-year return was greater than 8%? State your conclusion.

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Mutual Funds

Mutual funds are like a pool of funds gathered by different small investors that have simalar investment perspective about returns on their investments. These funds are managed by professional investment managers who act smartly on behalf of the...

Step by Step Answer:

Business Statistics

ISBN: 9780133899122

3rd Canadian Edition

Authors: Norean D. Sharpe, Richard D. De Veaux, Paul F. Velleman, David Wright