Let (X) be the stock price of SnowPeak Ltd, and let (Y) be the stock price of

Question:

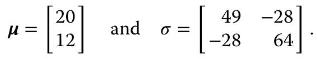

Let \(X\) be the stock price of SnowPeak Ltd, and let \(Y\) be the stock price of FjordWater Ltd. The prices of the two stocks are correlated, so \(Z=(X, Y)\) is binormally distributed with parameters

(a) Find the probability distribution for the price of each stock separately that is: the marginal probability distributions \(f_{x}(x)\) and \(f_{y}(y)\).

(b) Find the probability distribution of the stock price of each of the stocks as a function of the price of the other - that is: the conditional probability distributions \(f_{x \mid y}(x)\) and \(f_{y \mid x}(y)\).

(c) Find the distribution of \(Z\) as a rotation of an independent distribution.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

The Bayesian Way Introductory Statistics For Economists And Engineers

ISBN: 9781119246879

1st Edition

Authors: Svein Olav Nyberg

Question Posted: