Question: This problem asks you to construct a simple simulation model. If you do not own simulation software, see the directions for downloading simulation software under

This problem asks you to construct a simple simulation model. If you do not own simulation software, see the directions for downloading simulation software under Additional Resources.

a. Problem 9 earlier asked you to extend the forecast for R&E Supplies contained in Table 3.5 through 2023. Using the same spreadsheet, simulate R&E Supplies’ external funding requirements in 2023 under the following assumptions.

i. Represent the growth rate in net sales as a triangular distribution with a mean of 30 percent and a range of 25 to 35 percent.

ii. Represent the interest rate as a uniform distribution varying from 9 percent to 11 percent.

iii. Represent the tax rate as a lognormal distribution with a mean of 25 percent and a standard deviation of 2 percent.

b. If the treasurer wants to be 95 percent certain of raising enough money in 2023, how much should he raise? (Click the arrow on the right margin of your density function and select the Percentile Table.)

Data from Problem 9

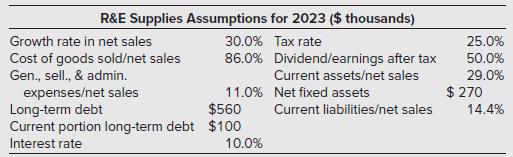

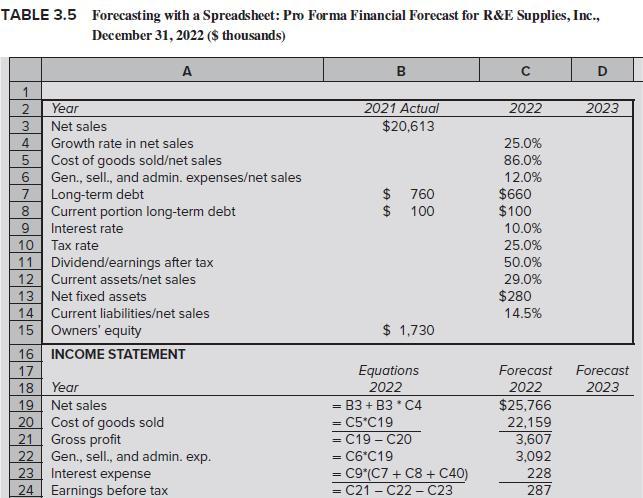

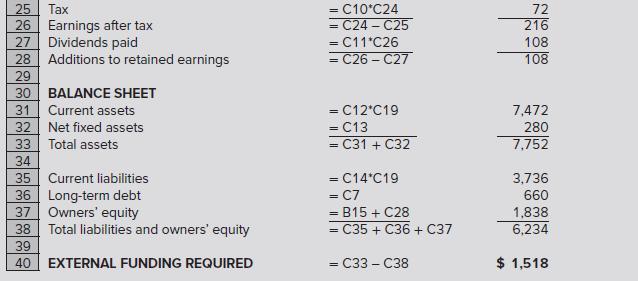

A spreadsheet containing R&E Supplies’ 2022 pro forma financial forecast, as shown in Table 3.5, is available for download from McGraw-Hill’s Connect or your course instructor (see the Preface for more information). Using the spreadsheet information presented next, and the modified equations determined in Problem 8 earlier, extend the forecast for R&E Supplies contained in Table 3.5 through 2023.

R&E Supplies Assumptions for 2023 ($ thousands) 30.0% Tax rate 86.0 % Dividend/earnings after tax Current assets/net sales Net fixed assets Current liabilities/net sales Growth rate in net sales Cost of goods sold/net sales Gen., sell., & admin. expenses/net sales 11.0% Long-term debt $560 Current portion long-term debt $100 Interest rate 10.0% 25.0% 50.0% 29.0% $ 270 14.4%

Step by Step Solution

3.26 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts