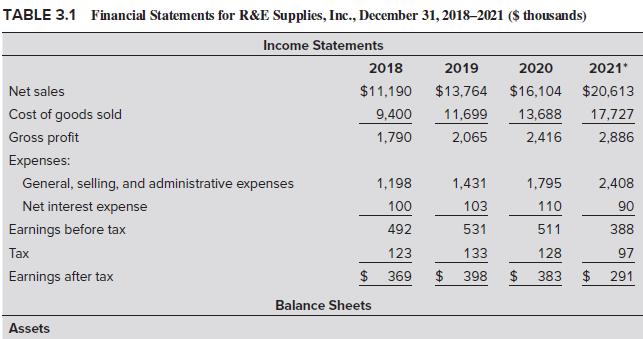

Question: Table 3.1 in the previous chapter presents financial statements for R&E Supplies for the period 2018 through 2021, and Table 3.5 presents a pro forma

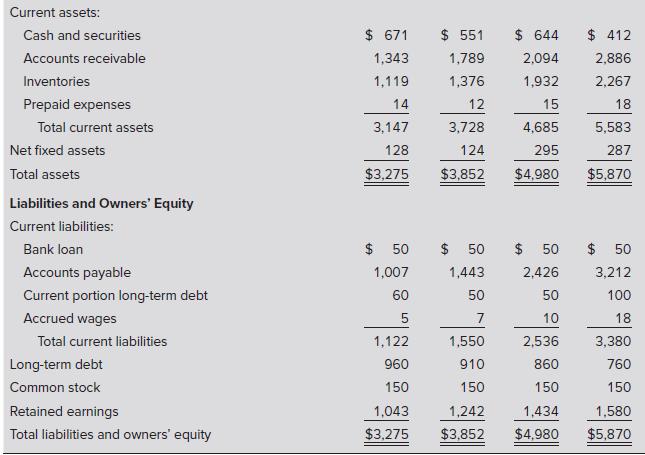

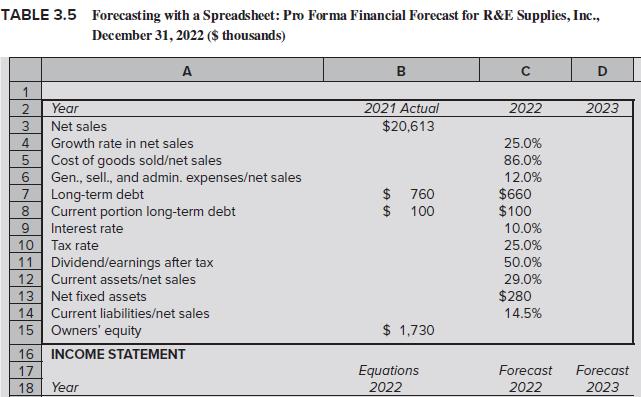

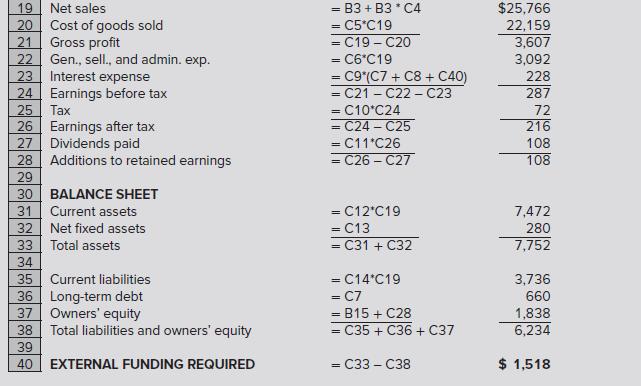

Table 3.1 in the previous chapter presents financial statements for R&E Supplies for the period 2018 through 2021, and Table 3.5 presents a pro forma financial forecast for 2022.

Use the information in these tables to answer the following questions.

a. Calculate R&E’s sustainable growth rate in each year from 2019 through 2022.

b. Comparing the company’s sustainable growth rate with its actual and projected growth rates in sales over these years, what growth management problems does R&E appear to face in this period?

c. How did the company cope with these problems? Do you see any difficulties with the way it addressed its growth problems over this period? If so, what are they?

d. What advice would you offer management regarding managing future growth?

Table 3.5

TABLE 3.1 Financial Statements for R&E Supplies, Inc., December 31, 2018-2021 ($ thousands) Income Statements Net sales Cost of goods sold Gross profit Expenses: General, selling, and administrative expenses Net interest expense Earnings before tax Tax Earnings after tax Assets 2018 2019 $11,190 $13,764 9,400 11,699 13,688 1,790 2,065 2,416 $ Balance Sheets 1,198 100 492 123 369 2020 2021* $16,104 $20,613 17,727 2,886 $ 1,431 103 531 133 398 $ 1,795 110 511 128 383 $ 2,408 90 388 97 291

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Solution a sustainable growth rate Return on equity1 dividend payout ratio dividend ... View full answer

Get step-by-step solutions from verified subject matter experts