Beketele started a business on 1 July 206. On that date she made the following payments. $

Question:

Beketele started a business on 1 July 20–6. On that date she made the following payments.

$

Premises .......................................................................... 215,000

Legal costs relating to purchase of premises ............. 2,150

Motor vehicle ............................................................. 9,800

Delivery costs of motor vehicle .............................. 200

Fuel for motor vehicle ....................................... 50

Insurance of motor vehicle ................................. 495

a. State whether each of these payments is capital expenditure or revenue expenditure.

Beketele decided to depreciate the motor vehicle by 20% per annum using the straight line method.

b. Calculate the accumulated depreciation on the motor vehicle on 1 July 20–8.

On 1 July 20–8 Beketele decided that the motor vehicle was no longer suitable and sold it for $5,600 which was received in cash.

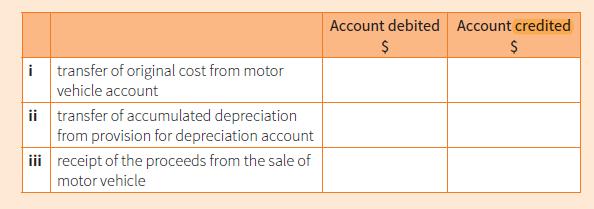

d. Complete the following table to show the debit and credit entries Beketele would make to record the disposal of the motor vehicle.

Step by Step Answer:

Cambridge IGCSE And O Level Accounting Coursebook

ISBN: 9781316502778

2nd Edition

Authors: Catherine Coucom