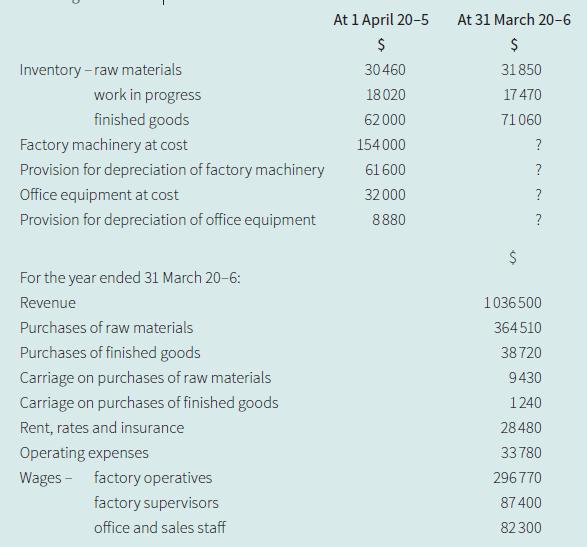

Pierre is a furniture manufacturer. His financial year ends on 31 March. He provided the following information:

Question:

Pierre is a furniture manufacturer. His financial year ends on 31 March. He provided the following information:

Additional information:

1. At 31 March 20–6 wages of factory operatives accrued amounted to $1,830.

2. At 31 March 20–6 rates and insurance prepaid amounted to $1,040.

3. Rent, rates and insurance are apportioned 3/4 to the factory and 1/4 to the offices.

4. Operating expenses are apportioned 2/3 to the factory and 1/3 to the offices.

5. Factory machinery, $18,000, was purchased on 1 October 20–5. No machinery was disposed of during the year. Factory machinery is being depreciated at 20% per annum on cost, from the date of purchase.

6. Office equipment is being depreciated at 15% per annum using the reducing balance method.

a. Prepare the manufacturing account for the year ended 31 March 20–6.

b. Prepare the income statement for the year ended 31 March 20–6.

c. Name the accounting principle Pierre is observing by valuing his inventories at the lower of cost and net realisable value.

d. Explain how Pierre is observing the principle of matching by making an adjustment for the prepaid rates and insurance.

e. Name the accounting principles Pierre is observing by depreciating his non-current assets.

Step by Step Answer:

Cambridge IGCSE And O Level Accounting Coursebook

ISBN: 9781316502778

2nd Edition

Authors: Catherine Coucom