The financial year of LS Limited ends on 30 June. The income statement for the year ended

Question:

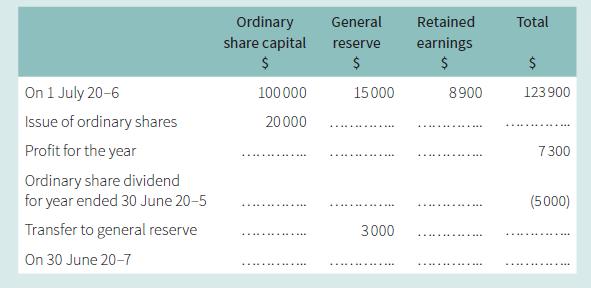

The financial year of LS Limited ends on 30 June. The income statement for the year ended 30 June 20–3 showed a profit for the year of $7,300.

a. Complete the following partially prepared statement of changes in equity for the year ended 30 June 20–3.

The following additional information is provided on 30 June 20–3:

$

Land and building at cost ...................................................................... 98,000

Fixtures and equipment at cost ......................................................... 50,000

Motor vehicles at cost ......................................................................... 36,000

Trade payables .............................................................................. 8,450

Trade receivables .......................................................................... 16,800

Other payables ................................................................................. 870

Other receivables ........................................................................... 650

Inventory .................................................................................. 15,680

Provision for doubtful debts ........................................................ 420

Provision for depreciation of fixtures and equipment ................ 13,550

Provision for depreciation of motor vehicles ............................... 22,500

5% debentures (repayable in 10 years) ............................ 20,000

Bank overdraft ........................................................................... 5,140

b. Prepare the statement of financial position at 30 June 20–3.

The directors of LS Limited are hoping to expand the business and estimate that $45,000 will be required. They discussed whether to issue ordinary shares or 5% debentures and decided to issue 5% debentures.

The directors do not expect the expansion to have any impact on the operating profit for the first three years. After that the annual operating profit is expected to increase by 10%.

c. State two features of ordinary shares.

d. State two features of debentures.

e. Calculate the annual profit after interest the company is expected to earn over each of the next three years.

f. Calculate the annual profit after interest the company is expected to earn in Year 4.

g. Suggest how the ordinary shareholders may be affected if it is decided to issue debentures rather than additional ordinary shares.

Step by Step Answer:

Cambridge IGCSE And O Level Accounting Coursebook

ISBN: 9781316502778

2nd Edition

Authors: Catherine Coucom