Julie Sami is required to use her own automobile and pay for all her travelling expenses in

Question:

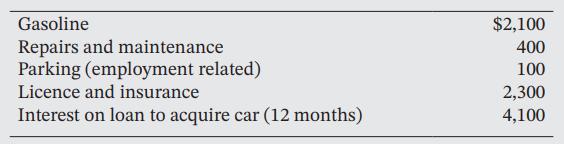

Julie Sami is required to use her own automobile and pay for all her travelling expenses in carrying out her duties of employment. She purchased a new car on January 2, 2022, for $45,000 (plus HST @ 13%) and incurred the following expenses during the year:

Julie drove her car 20,000 km in 2022, of which 8,000 km were for carrying out her duties of employment.

Calculate the maximum tax deduction available to Julie for her car for 2022. (The CCA rate for automobiles is 30%, except in the first year when the accelerated rate is 45%.)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Canadian Income Taxation 2022/2023

ISBN: 9781260881202

25th Edition

Authors: William Buckwold, Joan Kitunen, Matthew Roman

Question Posted: