Malia Garcia is a professional engineer. In 2022, she sold her consulting business in Hamilton, Ontario, and

Question:

Malia Garcia is a professional engineer. In 2022, she sold her consulting business in Hamilton, Ontario, and moved to Vancouver, British Columbia, where she was employed by an equipment-manufacturing business.

The following financial information is provided for 2022:

1. Malia began her employment on February 1, and during the year received a salary of $90,000, from which the employer deducted income tax of $25,000 and EI and CPP of $4,453. In addition to her salary, Malia earned a commission of 1% of sales obtained by salespeople under her supervision. At December 31, these sales amounted to $1,000,000, for which she had received $6,000 by the end of the year, with the balance received in January 2023.

2. Malia also receives an annual clothing allowance of $1,500. During the year, she spent $1,800 on clothing for work.

3. Malia’s employer does not have a company pension plan; instead, the employer contributes $13,000 directly to her RRSP.

4. In December, Malia received a payroll advance of $3,000 against her January 2023 salary to help fund a family holiday.

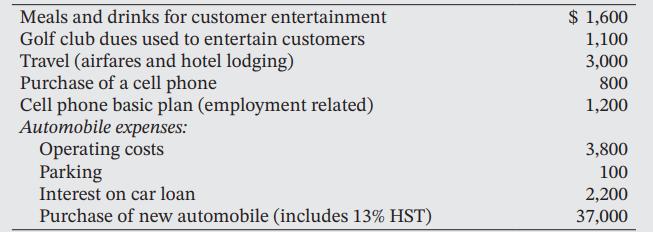

5. Malia is required to use her automobile for employment purposes and to pay certain other employment expenses. She incurred the following costs:

She used the automobile 60% of the time for business.

6. Malia took advantage of her employer’s counselling services. She received personal financial planning advice valued at $400, and her 14-year-old son received mental health counselling valued at $800.

7. Malia purchased a new home in Vancouver and incurred qualified moving expenses of $18,000 to transport her family and household effects to Vancouver. Her new employer reimbursed her for $10,000 of these costs and paid her $20,000 for the loss incurred on the sale of her former residence.

8. In early 2023, Malia intends to borrow $20,000 from her employer to help her acquire shares in the employer’s corporation. A low interest rate of 2% per annum will be payable on the loan.

Required:

(a) Determine Malia’s employment income for tax purposes for 2022. The CCA rate for automobiles is 30%, except in the first year when the accelerated rate is 45%.

(b) Briefly describe the tax implications from the intended employee loan to Malia. Assume the CRA’s prescribed interest rate is in excess of 2%.

Step by Step Answer:

Canadian Income Taxation 2022/2023

ISBN: 9781260881202

25th Edition

Authors: William Buckwold, Joan Kitunen, Matthew Roman