Richard Ahmed earns a salary of $70,000 in 2022 as an employee of B Ltd. He pays

Question:

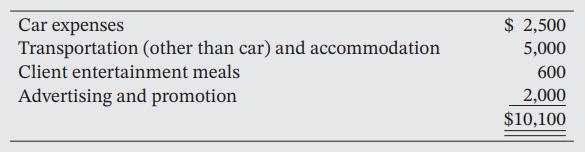

Richard Ahmed earns a salary of $70,000 in 2022 as an employee of B Ltd. He pays the following expenses to earn his income:

(a) Determine the maximum deduction for employment expenses that Richard is entitled to claim in computing his income for 2022.

(b) How would your answer to (a) change, if at all, if Richard was a salesperson and received commission income of $6,000 in addition to his salary, in 2022?

(c) How would your answer to (b) change, if at all, if Richard’s commission income were $20,000?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Canadian Income Taxation 2022/2023

ISBN: 9781260881202

25th Edition

Authors: William Buckwold, Joan Kitunen, Matthew Roman

Question Posted: