Question: A process heat recovery study identifies five potential modifications, none of which are mutually exclusive, with the costs and energy savings as follows: If fuel

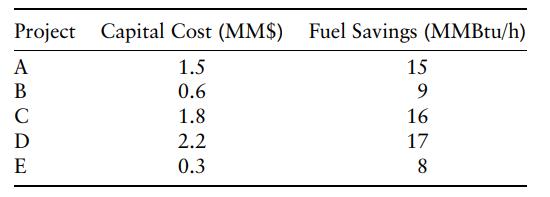

A process heat recovery study identifies five potential modifications, none of which are mutually exclusive, with the costs and energy savings as follows:

If fuel costs $6/MMBtu and the plant operates for 350 days/year, which projects have a simple payback period less than 1 year?

What is the maximum 10-year NPV that can be achieved with a 15% interest rate and a 35% tax rate? Assume all the projects can be built immediately and use MACRS depreciation with a 7-year recovery term. What combination of projects is selected to meet the maximum NPV?

Project Capital Cost (MM$) Fuel Savings (MMBtu/h) 1.5 0.6 1.8 A B C D E 2.2 0.3 15 9 16 17 8

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

To determine which projects have a simple payback period of less than 1 year we need to calculate the simple payback period for each project The simple payback period SPP is calculated by dividing the ... View full answer

Get step-by-step solutions from verified subject matter experts