Assume that you are the chief accountant for Elis Consulting Services. During January, the business will use

Question:

Assume that you are the chief accountant for Eli’s Consulting Services. During January, the business will use the same types of records and procedures that you learned about in Chapters 1 through 6. The chart of accounts for Eli’s Consulting Services has been expanded to include a few new accounts. Follow the instructions to complete the accounting records for the month of January.

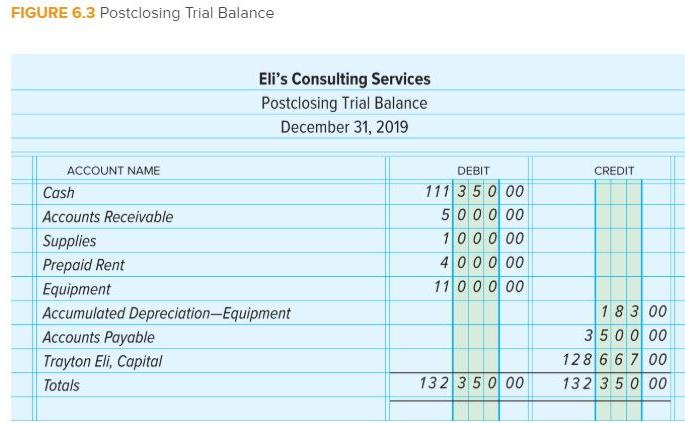

1. Open the general ledger accounts and enter the balances for January 1, 20X2. Obtain the necessary figures from the postclosing trial balance prepared on December 31, 20X1, which appears in Figure 6.3.

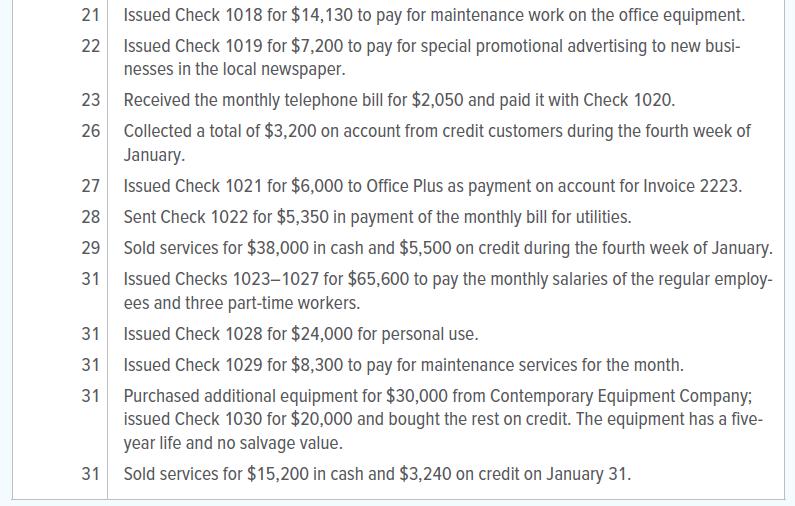

2. Analyze each transaction and record it in the general journal.

2. Analyze each transaction and record it in the general journal.

3. Post the transactions to the general ledger accounts.

4. Prepare the Trial Balance section of the worksheet.

5. Prepare the Adjustments section of the worksheet.

a. Compute and record the adjustment for supplies used during the month. An inventory taken on January 31 showed supplies of $9,400 on hand.

b. Compute and record the adjustment for expired insurance for the month.

c. Record the adjustment for one month of expired rent of $4,000.

d. Record the adjustment for depreciation of $183 on the old equipment for the month. The first adjustment for depreciation for the new equipment will be recorded in February.

6. Complete the worksheet.

7. Prepare an income statement for the month.

8. Prepare a statement of owner’s equity.

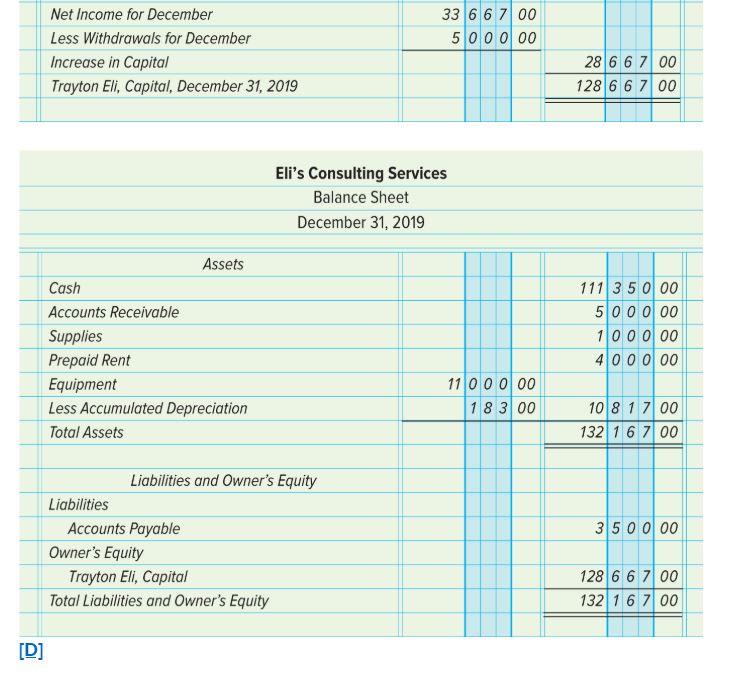

9. Prepare a balance sheet using the report form.

10. Journalize and post the adjusting entries.

11. Journalize and post the closing entries.

12. Prepare a post closing trial balance.

Analyze:

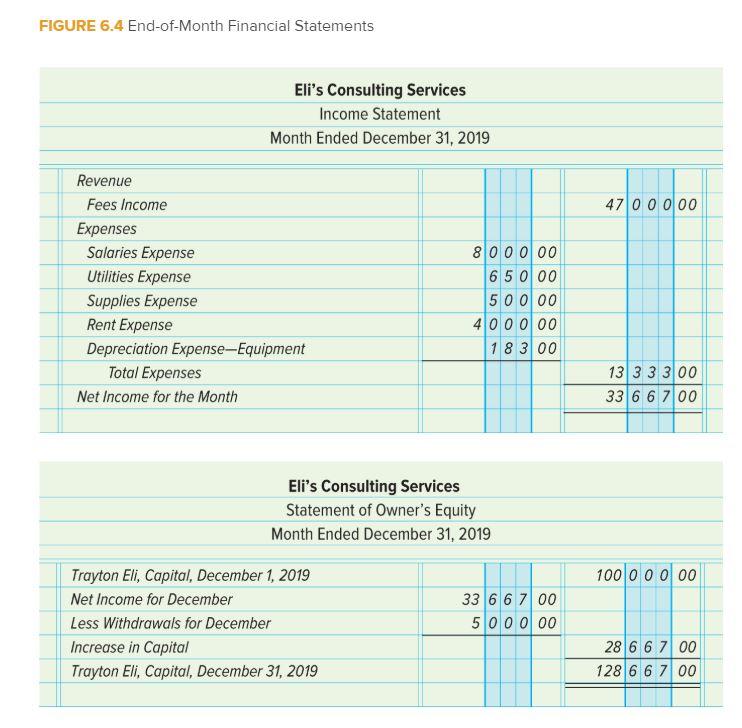

Compare the January 31 balance sheet you prepared with the December 31 balance sheet shown in Figure 6.4.

a. What changes occurred in total assets, liabilities, and the owner’s ending capital?

b. What changes occurred in the Cash and Accounts Receivable accounts?

c. Has there been an improvement in the firm’s financial position? Why or why not?

Step by Step Answer:

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina