Question: The following selected accounts were taken from the financial records of Sonoma Valley Distributors at December 31, 20X1. All accounts have normal balances. Accounts Receivable

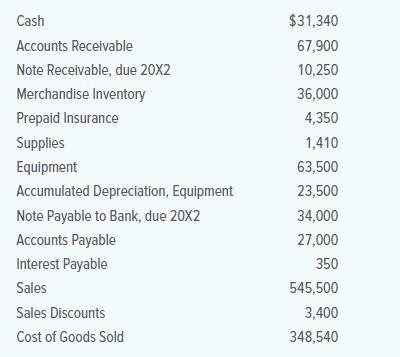

The following selected accounts were taken from the financial records of Sonoma Valley Distributors at December 31, 20X1. All accounts have normal balances.

Accounts Receivable at December 31, 20X0, was $52,550. Merchandise Inventory at December 31, 20X0, was $58,200. Based on the account balances above, calculate the following:

a. The gross profit percentage

b. Working capital

c. The current ratio

d. The inventory turnover

e. The accounts receivable turnover. All sales were on credit.

Cash Accounts Receivable Note Receivable, due 20X2 Merchandise Inventory Prepaid Insurance Supplies Equipment Accumulated Depreciation, Equipment Note Payable to Bank, due 20X2 Accounts Payable Interest Payable Sales Sales Discounts Cost of Goods Sold $31,340 67,900 10,250 36,000 4,350 1,410 63,500 23,500 34,000 27,000 350 545,500 3,400 348,540

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

1 Gross profit percentage Gross profit Net sales 100 Net sales 545500 3400 542100 ... View full answer

Get step-by-step solutions from verified subject matter experts