Question: On October 1, Organic Farming purchases wind turbines for $170,000. The wind turbines are expected to last five years, have a salvage value of

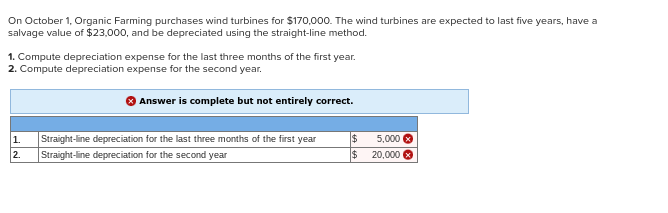

On October 1, Organic Farming purchases wind turbines for $170,000. The wind turbines are expected to last five years, have a salvage value of $23,000, and be depreciated using the straight-line method. 1. Compute depreciation expense for the last three months of the first year. 2. Compute depreciation expense for the second year. Answer is complete but not entirely correct. 1. Straight-line depreciation for the last three months of the first year $ 2. Straight-line depreciation for the second year $ 5,000 20,000 >

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

140000 20000 Cost of the turbine ... View full answer

Get step-by-step solutions from verified subject matter experts