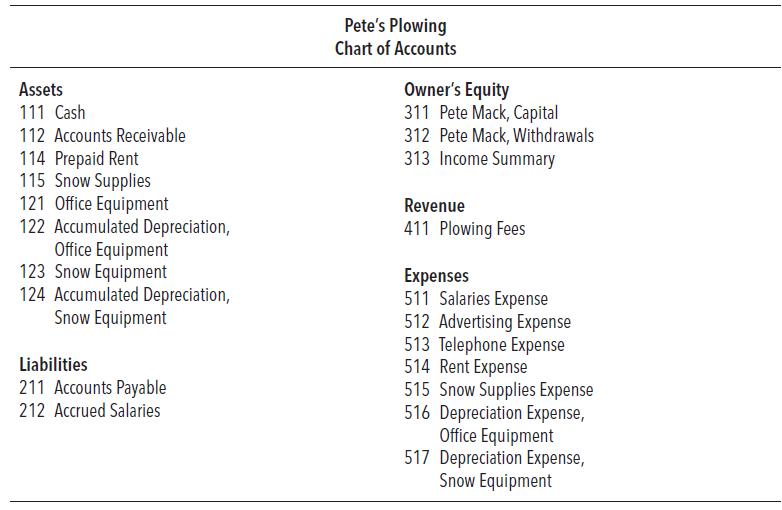

As the bookkeeper of Petes Plowing of Fredericton, you have been asked to complete the entire accounting

Question:

As the bookkeeper of Pete’s Plowing of Fredericton, you have been asked to complete the entire accounting cycle for Pete from the following information:

2021

Jan.

3 Pete invested $7,000 cash and $6,000 worth of snow equipment in the plowing company.

3 Paid rent in advance for garage space, $2,000.

5 Purchased office equipment on account from Ling Corp., $7,200.

6 Purchased snow supplies for $700 cash.

9 Collected $15,000 from plowing local shopping centres.

12 Pete Mack withdrew $1,000 from the business for personal use.

20 Plowed North East Co. parking lots, payment not to be received until March, $5,000.

26 Paid salaries to employees, $1,800.

27 Paid Ling Corp. one-half amount owed for office equipment.

30 Advertising bill was received from Bush Co. but will not be paid until March, $900.

31 Paid telephone bill, $210.

Adjustment Data

a. Snow supplies on hand, $400.

b. Rent expired, $600.

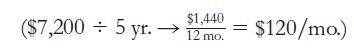

c. Depreciation on office equipment, $120.

d. Depreciation on snow equipment, $100.

![]()

e. Accrued salaries, $190.

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 9780135222416

14th Canadian Edition

Authors: Jeffrey Slater, Debra Good