Christine Ballantyne, the accountant for Smurk Co. of Shelburne, has gathered the following data for the September

Question:

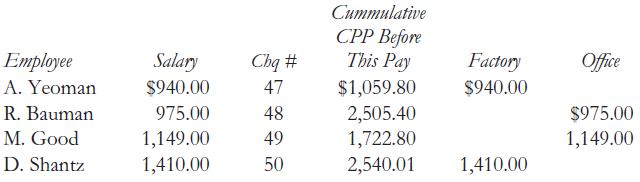

Christine Ballantyne, the accountant for Smurk Co. of Shelburne, has gathered the following data for the September 23 weekly payroll.

Assumptions

1. Income taxes are calculated at 20%, CPP at 4.95%, and EI at 1.88%.

Required

a. Prepare a payroll register for September 23.

b. Journalize and post the payroll entry

Transcribed Image Text:

Cummulative CPP Before This Pay Employee Factory $940.00 Salary Chq # Office A. Yeoman $940.00 47 $1,059.80 R. Bauman 975.00 48 2,505.40 1,722.80 $975.00 M. Good 1,149.00 49 1,149.00 D. Shantz 1,410.00 50 2,540.01 1,410.00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 54% (11 reviews)

a Employees have reached their maximum contribution in this pay b Employee A Yeoman R Bauman M Good ...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

College Accounting A Practical Approach

ISBN: 978-0134166698

13th Canadian edition

Authors: Jeffrey Slater, Debra Good

Question Posted:

Students also viewed these Business questions

-

Outline how deferred income taxes are calculated.

-

The accountant for Spring Board Co. has provided you with the following information for the month of October 2015. October Bank Statement: Cash Account Transactions for October: GL ACCOUNT: 1020 Cash...

-

The accountant for Eagle Medical Co., a medical services consulting firm, mistakenly omitted adjusting entries for (a) unearned revenue earned during the year ($30,000) and (b) accrued wages...

-

It is reported that 85% of Asian, 78% of white, 70% of Hispanic, and 38% of black children have two parents at home. Suppose there are 500 students in a representative school, of which 280 are white,...

-

Find a connected weighted simple graph with the fewest edges possible that has more than one minimum spanning tree.

-

Prove that (x) = x 4 + 5x 3 + 4x has no root c satisfying c > 0. x = 0 is a root and apply Rolles Theorem. THEOREM 4 Rolle's Theorem Assume that f is continuous on [a, b] and differen- tiable on (a,...

-

In the organizational chart for the consumer-packaged goods firm in Figure 22 5, where do product line, functional, and geographical groupings occur? Figure 22-5 Chief Marketing Officer or Vice...

-

Utility Systems of America, Inc., was doing roadwork when Chad DeRosier, a nearby landowner, asked Utility to dump 1,500 cubic yards of fill onto his property. Utility agreed but exceeded DeRosiers...

-

Why is it important to learn SQL? In which jobs you need to know SQL? 2A- What is the definition of DML and DDL? Give examples in each case. 2B- Consider the following two tables below: VENDOR and...

-

Direct material budget Inglenook Co. produces wine. The company expects to produce 2500,000 two-liter bottles of Chablis in 2010. Inglenook purchases empty glass bottles from an outside vendor. Its...

-

The payroll clerk for the Marlin Company of Armstrong assembled the following data for the companys five employees before suddenly becoming quite ill. You have been approached to complete the payroll...

-

Adams DJ Services has three employees who work on an hourly basis and are paid weekly. The current CPP rate is 4.95%; the current EI rate is 1.88%; and the appropriate income tax rate is 23%. Each...

-

Use the algorithm from this section to find the inverses of Let A be the corresponding n x n matrix, and let B be its inverse. Guess the form of B, and then prove that AB = I and BA = I. 1 0 0 1] 1 0...

-

Dome Metals has credit sales of $378,000 yearly with credit terms of net 60 days, which is also the average collection period. Dome does not offer a discount for early payment, so its customers take...

-

Identify which VALS Framework archetype you would associate with Charlie Brown from the peanuts. please help identify a persona for Charlie Brown. what would be a marketing message you would use to...

-

Jing is having some building work done at her apartment and has been offered different options to make payments: For answering the following questions, no specific calculations are needed - just an...

-

A speaker needs to be viewed as credible in order to persuade an audience. Logical fallacies in an argument can diminish the speaker's credibility. Choose 2 different fallacies and determine methods...

-

MODULE Losson Four III TYPES OF SPEECH CONTEXT INTRODUCTION Humans are naturally social beings; they are made to interact with others at any given chance and various contexts. They may be talking to...

-

Lee Company accepts a $27,000, four-month, 6% note receivable in settlement of an account receivable on June 1, 2014. Interest is to be paid at maturity. Lee Company has a December 31 year end and...

-

Kims Konstructions has assembled the following data for a proposed straw-reinforced brick maker (SRBM): SRBM Cost: $26,000 Life: 5 years Revenue (p.a.) $11,000 Operating Expenses (p.a.) $3,000...

-

Bill See has asked you to prepare a balance sheet as of September 30, 2023, for Sees Internet Service of Halifax. Assist Bill. B. See, Capital .................................... $24,000 Accounts...

-

Arjun Agarwal is the accountant for Sees Internet Service. His task is to construct a balance sheet from the following information, as of September 30, 2023, in proper form. Could you help him?...

-

Analysis of Financial StatementsRoots Corporation Roots Corporation, or Roots, is a publicly held Canadian brand that sells apparel for women, men, children, and babies; leather bags; footwear;...

-

= On 1/1/X4, Phillip invested $1,100,000 in Sleeper's ordinary shares (35% owned). Sleeper reported: Assets $3,500,000 Liabilities 600,000 The book value of Sleeper's net assets approximated market...

-

You are performing research on the development of optomechanical systems. In one of your experiments, a uniform circular disk of mass m = 24.8 g and radius r = 39.0 cm hangs vertically from a fixed,...

-

Jason owns an office complex in Tucson, Arizona. One day, the air conditioning unit is not functioning and he has to hire a maintenance crew to fix it for $2,000. May Jason deduct this as a business...

Study smarter with the SolutionInn App