Question:

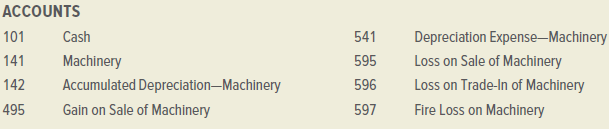

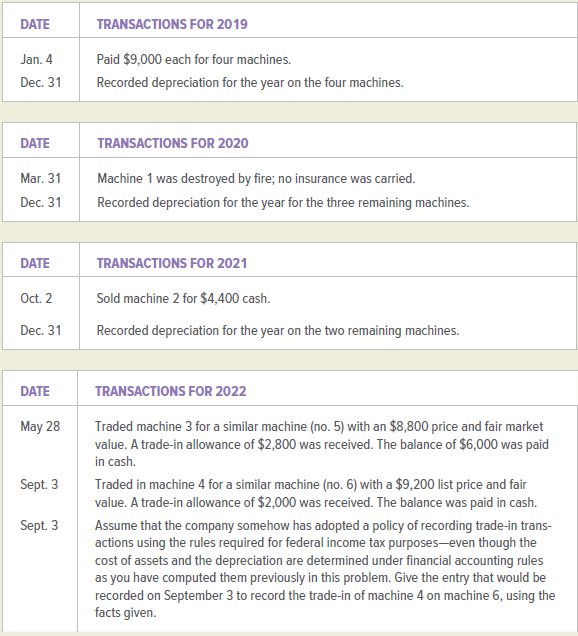

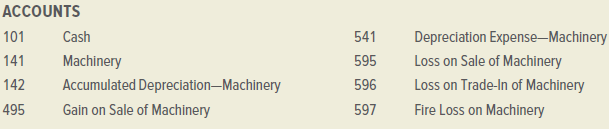

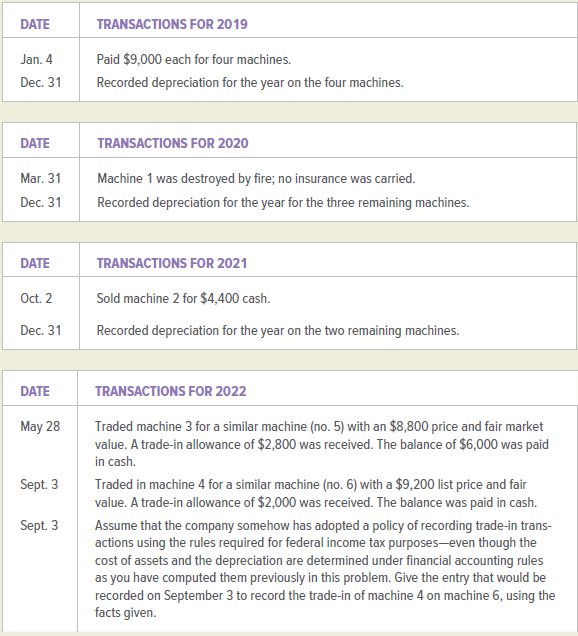

Freedom Company purchased four identical machines on January 4, 2019, paying $9,000 for each machine. The useful life of each machine is expected to be five years, with no

salvage value expected. The company uses the straight-line method of depreciation. Selected transactions involving the machines are listed below. The necessary accounts for recording these transactions are also given.

INSTRUCTIONS

Record the transactions in general journal form. Use the following accounts, as necessary.

Analyze: What is the difference between the financial accounting entries and tax entries for the trade-in of machine 4?

Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Transcribed Image Text:

ACCOUNTS Cash Depreciation Expense–Machinery Loss on Sale of Machinery Loss on Trade-In of Machinery Fire Loss on Machinery 101 541 595 596 141 Machinery Accumulated Depreciation–Machinery Gain on Sale of Machinery 142 495 597 DATE TRANSACTIONS FOR 2019 Jan. 4 Paid $9,000 each for four machines. Dec. 31 Recorded depreciation for the year on the four machines. DATE TRANSACTIONS FOR 2020 Mar. 31 Machine 1 was destroyed by fire; no insurance was carried. Dec. 31 Recorded depreciation for the year for the three remaining machines. DATE TRANSACTIONS FOR 2021 Oct. 2 Sold machine 2 for $4,400 cash. Dec. 31 Recorded depreciation for the year on the two remaining machines. DATE TRANSACTIONS FOR 2022 Traded machine 3 for a similar machine (no. 5) with an $8,800 price and fair market value. A trade-in allowance of $2,800 was received. The balance of $6,000 was paid in cash. May 28 Traded in machine 4 for a similar machine (no. 6) with a $9,200 list price and fair value. A trade-in allowance of $2,000 was received. The balance was paid in cash. Sept. 3 Sept. 3 Assume that the company somehow has adopted a policy of recording trade-in trans- actions using the rules required for federal income tax purposes-even though the cost of assets and the depreciation are determined under financial accounting rules as you have computed them previously in this problem. Give the entry that would be recorded on September 3 to record the trade-in of machine 4 on machine 6, using the facts given.