James Company purchased four identical machines on January 10, 2019, paying $5,500 for each. The useful life

Question:

INSTRUCTIONS

Record the transactions in general journal form. Round all calculations to the nearest whole dollar.

ACCOUNTS

101 Cash

141 Machinery

142 Accumulated Depreciation€”Machinery

495 Gain on Sale of Machinery

541 Depreciation Expense€”Machinery

595 Loss on Sale of Machinery

597 Loss on Stolen Machinery

Analyze: What is the balance of the Accumulated Depreciation account on December 31, 2022?

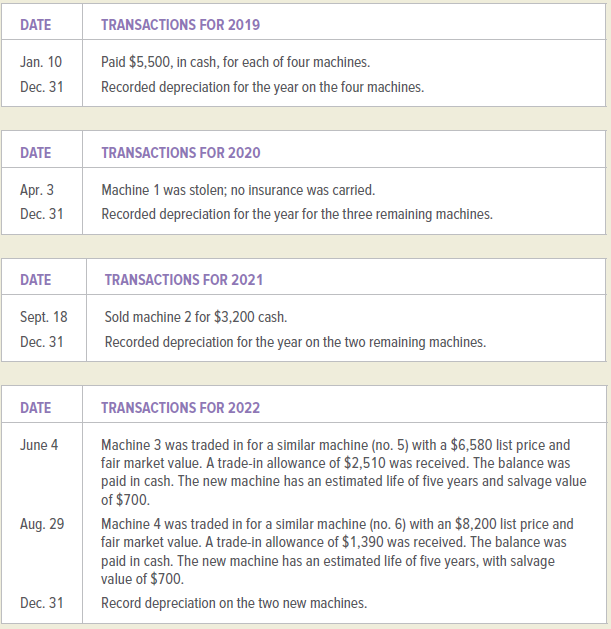

DATE TRANSACTIONS FOR 2019 Paid $5,500, in cash, for each of four machines. Jan. 10 Dec. 31 Recorded depreciation for the year on the four machines. DATE TRANSACTIONS FOR 2020 Apr. 3 Machine 1 was stolen; no insurance was carried. Dec. 31 Recorded depreciation for the year for the three remaining machines. DATE TRANSACTIONS FOR 2021 Sold machine 2 for $3,200 cash. Sept. 18 Dec. 31 Recorded depreciation for the year on the two remaining machines. DATE TRANSACTIONS FOR 2022 Machine 3 was traded in for a similar machine (no. 5) with a $6,580 list price and fair market value. A trade-in allowance of $2,510 was received. The balance was paid in cash. The new machine has an estimated life of five years and salvage value of $700. June 4 Machine 4 was traded in for a similar machine (no. 6) with an $8,200 list price and fair market value. A trade-in allowance of $1,390 was received. The balance was paid in cash. The new machine has an estimated life of five years, with salvage value of $700. Aug. 29 Dec. 31 Record depreciation on the two new machines.

Step by Step Answer:

GENERAL JOURNAL PAGE DATE DESCRIPTION POST REF DEBIT CREDIT 2019 Jan 10 Machinery 22 0 0 0 00 Cash 22 0 0 0 00 Purchased four machines at 5500 each es...View the full answer

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

Dear Company purchased four identical machines on January 10, 2016, paying $5,500 for each. The useful life of each machine is expected to be five years, with a salvage value of $700 each. The...

-

Liberty Company purchased four identical machines on January 4, 2016, paying $9,000 for each machine. The useful life of each machine is expected to be five years, with no salvage value expected. The...

-

Freedom Company purchased four identical machines on January 4, 2019, paying $9,000 for each machine. The useful life of each machine is expected to be five years, with no salvage value expected. The...

-

Both high-income and low-income employees are covered by cafeteria plans. Under such plans, all employees may select from a list of non-taxable fringe benefits or they may elect to receive cash in...

-

What is miscellaneous expense?

-

Three students have each saved $1,000. Each has an investment opportunity in which he or she can invest up to $2,000. Here are the rates of return on the students investment projects: Harry.............

-

Consider the property valuation data found in Table B.4. a. Use the all-possible-regressions method to find the "best" set of regressors. b. Use stepwise regression to select a subset regression...

-

Which portfolio is better diversified, one that contains stock in a dental supply company and a candy company or one that contains stock in a dental supply company and a dairy product company?

-

Placid Lake Corporation acquired 8 0 percent of the outstanding voting stock of Scenic, Incorporated, on January 1 , 2 0 2 3 , when Scenic had a net book value of $ 4 8 0 , 0 0 0 . Any excess fair...

-

Bill is a 45-year-old who is suffering from depression. He has recently lost his job and has difficulty keeping friendships. He believes there is no use in trying to find a job or in meeting new...

-

The transactions listed below occurred at Jarred Company during 2019: INSTRUCTIONS In following these instructions, assume that straight-line depreciation is used and that depreciation was last...

-

Yellowstone Mining Company had total depletable capitalized costs of $828,000 for a mine acquired in early 2019. It was estimated that the mine contained 920,000 tons of recoverable ore when...

-

Quick Print Inc. uses plain and three-hole-punched paper for copying needs. Demand for each paper type is highly variable. Weekly demand for the plain paper is estimated to be normally distributed...

-

Consider the three player normal form game described by the payoff matrices below. Players 1 and 2 have two choices each while player 3 has three choices. Player 3 choices correspond to each of the...

-

Company A is financed by 29% of debt and the rest of the company is financed by common equity. The company's before-tax cost of debt is 3.5%, and its cost of equity is 6.9%. If the marginal tax rate...

-

c) Your recent research into The Coca Cola company reveals the following information: B=-0.29749 Market return = 0.93% Risk-free rate = 0.5% i) Using the CAPM equation, populate the table below....

-

Discuss the concept of "ethno-nationalism" and its manifestations in contemporary politics, including its impact on issues such as citizenship, immigration policies, and ethno-cultural conflicts ?

-

How do intersectional approaches to ethnicity, such as those informed by Kimberl Crenshaw's work on intersectionality, deepen our understanding of how race, gender, class, and other axes of identity...

-

At i = 8% per year, the annual worth for years 1 through 6 of the cash flows shown is closest to: (a) $302 (b) $421 (c) $572 (d) $824 Years 1 2 4 5 300 400 500 600 700 800 3.

-

Identify the source of funds within Micro Credit? How does this differ from traditional sources of financing? What internal and external governance mechanisms are in place in Micro Credit?

-

The following data pertains to the operations of Eastern Industries for the year ended December 31, 2016, its first year of operations. Eastern Industries makes kitchen appliances. Round ending...

-

Pitt Corporation began operations in 2016 to manufacture a single product. Relevant data for the year follow. There are no work in process inventories. OPERATING DATA FOR 2016 Quantities: Beginning...

-

Exterior Manufacturing makes doors, which it sells to home builders. The firm's finishing department is not mechanized. Employees use hand tools to finish the product. The factory superintendent has...

-

Johnny's Lawn Service camed $200,000 of service revenues for 2020. $190,000 was collected in cash and $10,000 remains in Accounts Receivable as of 12/31/20. S155,000 of expense was incurred during...

-

Company BW has $500,000 loan outstanding. The annual loan interest rate is 6% with monthly compounding (meaning BW is making monthly payments). Find the annual after-tax cost of debt for the loan.

-

The hierarchical system of classification is intended to be a map of evolution. Explain this statement. What is implied about species that occur on the same branch of a phylogenetic tree?

Study smarter with the SolutionInn App