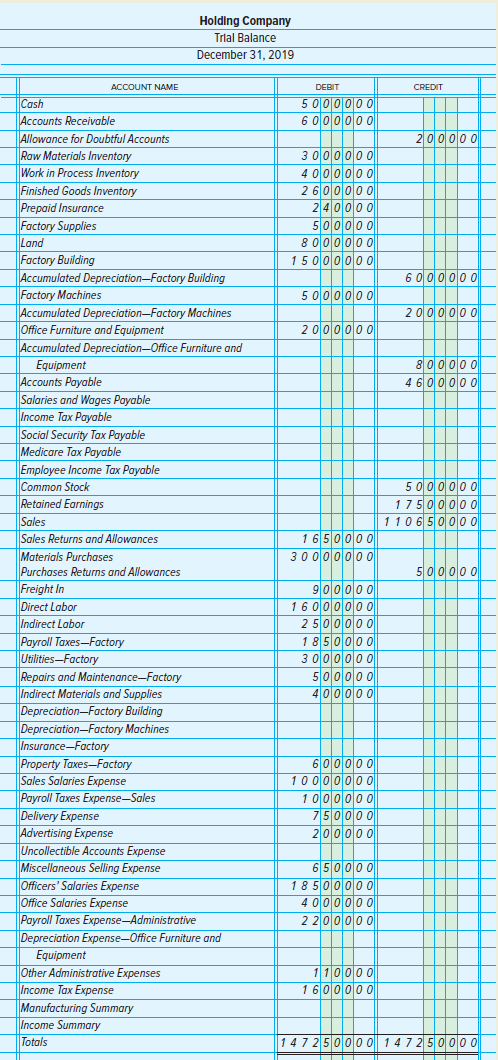

Holding Company makes shipping containers. The Trial Balance section of its worksheet and other year-end data follow.

Question:

INSTRUCTIONS

1. Prepare a 12-column manufacturing worksheet for the fiscal year ended December 31, 2019. Enter the trial balance in the first two columns.

2. Using the data given, enter the adjustments and complete the worksheet. Label all inventory adjustments as (a).

3. Prepare a statement of cost of goods manufactured.

4. Prepare an income statement.

5. Prepare a statement of retained earnings. Additional data follows:

a. Balance of Retained Earnings, January 1, was $185,000.

b. Dividends declared and paid on common stock during the year were $10,000.

6. Prepare a balance sheet as of December 31, 2019. Common Stock, $1 par, was authorized for 100,000 shares and 50,000 shares were outstanding.

7. Record the adjusting entries shown on the worksheet in general journal form. For each journal entry, use the letter that identifies the adjustment on the worksheet. Make a separate entry for each inventory adjustment. Do not give explanations.

8. Prepare the closing entries for all accounts involved in the cost of goods manufactured.

9. Prepare the closing entries for all revenue and expense accounts and the Manufacturing Summary account.

10. Prepare the closing entry to close the Income Summary account.

11. Journalize the reversing entries. Date the entries January 1, 2020.

YEAR-END DATA

a. Ending inventories: finished goods, $25,000; work in process, $36,000; and raw materials, $21,000.

b. Estimated uncollectible accounts: increase Allowance for Uncollectible Accounts to 4 percent of Accounts Receivable.

c. Expired insurance, $2,000; debit the Insurance€”Factory account for the amount of the necessary adjustment.

d. Factory supplies on hand, $1,000.

e. Depreciation for the year: on factory building, $15,000; on factory machinery, $5,000; and on office equipment, $2,000.

f. Accrued factory wages: direct labor, $1,800; indirect labor, $200.

g. Accrued payroll taxes: social security, $124; Medicare tax, $29.

h. Total income tax expense for the year, $34,212.

Analyze: Assume that the industry standard for direct labor costs in its manufacturing industry is 31 percent of costs of goods manufactured. How does this company compare to others in regard to this standard? Explain.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina