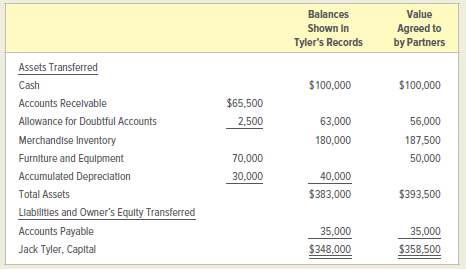

Question: Jack Tyler operates a store that sells computer software. Tyler has agreed to enter into a partnership with Oliver Preston, effective January 1, 2019. The

INSTRUCTIONS

1. Prepare the general journal entries to record the following transactions in the books of the partnership on January 1, 2019:

a. Receipt of Tyler€™s investment of assets and liabilities.

b. Receipt of Preston€™s investment of cash.

2. Prepare a balance sheet for the partnership as of the beginning of its operations on January 1, 2019.

Analyze: Based on the balance sheet you have prepared, what percentage (to the nearest 1/10 of 1%) of total equity is owned by Jack Tyler?

Balances Value Shown In Agreed to by Partners Tyler's Records Assets Transferred $ 100,000 $100,000 Cash $65,500 Accounts Recelvable Allowance for Doubtful Accounts 2,500 63,000 56,000 Merchandise Inventory 187,500 180,000 Furniture and Equipment 70,000 50,000 Accumulated Depreclation 30,000 40,000 Total Assets $383,000 $393,500 Llabilittes and Owner's Equity Transferred Accounts Payable 35,000 35,000 Jack Tyler, Capital $348,000 $358,500

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

GENERAL JOURNAL PAGE DATE ACCOUNTS POST REF DEBIT CREDIT 2019 Jan 1 Cash 100 0 0 0 00 Accoun... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1508_604075ce3ed2a_676601.xlsx

300 KBs Excel File