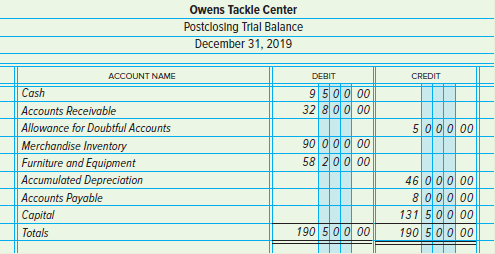

Terrell Owens operates a small shop that sells fishing equipment. His postclosing trial balance on December 31,

Question:

Owens plans to enter into a partnership with Cathy Turner, effective January 1, 2020. Profits and losses will be shared equally. Owens is to transfer all assets and liabilities of his store to the partnership after revaluation as agreed. Turner will invest cash equal to Owens€™s investment after revaluation. The agreed values are Accounts Receivable (net), $29,000; Merchandise Inventory, $99,800; and Furniture and Equipment, $24,600. The partnership will operate as Owens and Turner Angler€™s Outpost.

INSTRUCTIONS

1. In general journal form, prepare the entries to record:

a. The receipt of Owens€™s investment of assets and liabilities by the partnership.

b. The receipt of Turner€™s investment of cash.

2. Prepare a balance sheet for Owens and Turner Angler€™s Outpost just after the investments.

Analyze: By what net amount were the net assets of Owens Tackle Center adjusted before they were transferred to the partnership?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina

Question Posted: