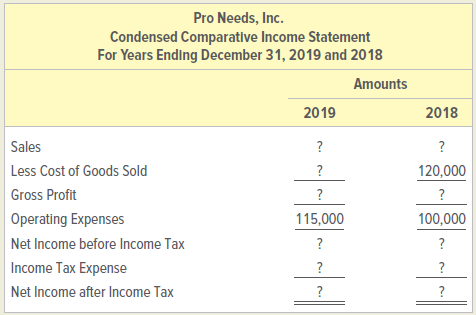

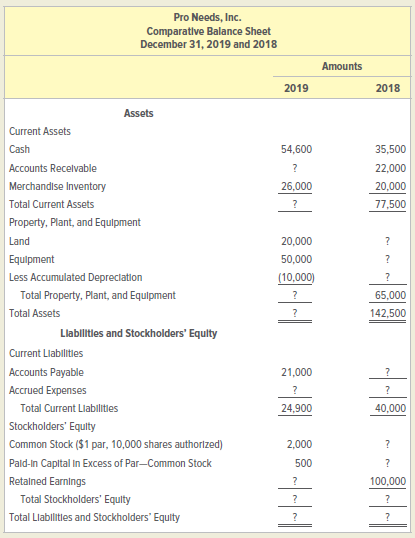

Question: Pro Needs Inc.s condensed income statement and balance sheet for the years 2019 and 2018 follow. INSTRUCTIONS Using the following additional information, fill in the

Pro Needs Inc.€™s condensed income statement and balance sheet for the years 2019 and 2018 follow.

INSTRUCTIONS

Using the following additional information, fill in the missing values:

1. Accounts Receivable increased 50 percent from 2018 to 2019.

2. There were no new purchases of land, property, or equipment in 2019.

3. Accounts Payable decreased 40 percent from 2018 to 2019.

4. No new shares of common stock were issued in 2019.

5. The company paid out cash dividends of $43,048 in 2019.

6. The inventory turnover ratio for 2019 was 6 times.

7. The asset turnover ratio in 2019 was 2.1 times and in 2018 was 2.0 times.

8. The earnings per share in 2019 was $44.624 and in 2018 was $26.00.

9. The effective income tax rate in both years was 20 percent.

Analyze: Assume that the management of Pro Needs Inc. had been given a directive by the board of directors to improve the company€™s current ratio in 2019. Did the company improve its standing in this regard from the prior year?

Pro Needs, Inc. Condensed Comparative Income Statement For Years Ending December 31, 2019 and 2018 Amounts 2019 2018 Sales ? ? Less Cost of Goods Sold 120,000 ? Gross Profit 100,000 Operating Expenses 115,000 Net Income before Income Tax ? Income Tax Expense Net Income after Income Tax Pro Needs, Inc. Comparative Balance Sheet December 31, 2019 and 2018 Amounts 2019 2018 Assets Current Assets Cash 54,600 35,500 Accounts Recelvable 22,000 Merchandlse Inventory Total Current Assets Property, Plant, and Equilpment Land Equipment Less Accumulated Depreciation 26,000 20,000 77,500 20,000 50,000 (10,000) Total Property, Plant, and Equipment 65,000 Total Assets 142,500 Llabltles and Stockholders' Equlty Current Llabilities Accounts Payable 21,000 Accrued Expenses Total Current Llabilitles 24,900 40,000 Stockholders' Equilty Common Stock ($1 par, 10,000 shares authorized) 2,000 Pald-In Capltal in Excess of Par-Common Stock Retalned Earnings 500 100,000 Total Stockholders' Equity Total Llabilitles and Stockholders' Equlty

Step by Step Solution

3.52 Rating (189 Votes )

There are 3 Steps involved in it

Pro Needs Inc Comparative Income Statement For Years Ending December 31 2019 and 2018 AMOUNTS 2019 2... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1508_604b3f3035e88_677650.xlsx

300 KBs Excel File