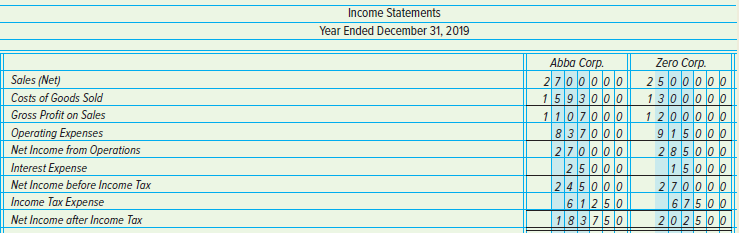

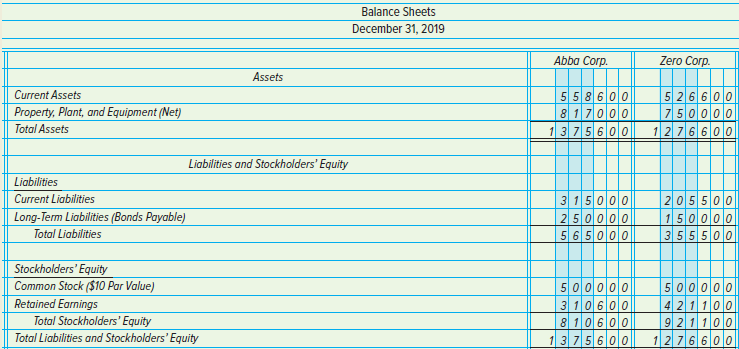

Question: Condensed financial statements for Abba Corp. and Zero Corp. for 2019 follow: INSTRUCTIONS 1. Compute the following ratios for each company: a. Rate of return

INSTRUCTIONS

1. Compute the following ratios for each company:

a. Rate of return on net sales

b. Rate of return on total assets at end of year

c. Rate of return on stockholders€™ equity at end of year

d. Earnings per share of common stock

e. Ratio of stockholders€™ equity to total equities

f. Current ratio

g. Asset turnover

h. Book value per share of common stock

2. Comment on the similarities and differences in the ratios computed for the two companies, pointing out the major factor that causes differences.

3. In which corporation would stock ownership be riskier? Explain.

4. Would you consider the extension of short-term credit to Abba Corp. or Zero Corp. riskier? Explain.

Analyze: What percentage of net sales was expended for operating expenses by Abba Corp.? By Zero Corp.?

Income Statements Year Ended December 31, 2019 Abba Corp. Zero Corp. Sales (Net) Costs of Goods Sold Gross Profit on Sales 2700000 1593000 1107000 837000 270000 2 5000|| 250000o 1300000 Operating Expenses Net Income from Operations Interest Expense Net Income before Income Tax Income Tax Expense Net Income after Income Tax 915000 285000 15000 270000 6 7500 20 25 0 0 6 12 5 0 183750 Balance Sheets December 31, 2019 Abba Corp. Zero Corp. Assets 5 5 8 600 8101010 1375600 Current Assets 526600 Property, Plant, and Equipment (Net) 7 50000 Total Assets 12 7660 0 Liabilities and Stockholders' Equity Liabilities 3 15000 250000 5 6 5000 205500 150000 3 55 500 Current Liabilities Long-Term Liabilities (Bonds Payable) Total Liabilities Stockholders' Equity 50 0000 3 10600 8 10600 1 3 75600 Common Stock ($10 Par Value) 500000 4 2 1 100 9 2 1 100 12 7660 0 Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

1 2 Both companies have similar current earnings records The Zero Corp has a slightly better balance ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1508_6041c0a1dbb60_677649.xlsx

300 KBs Excel File