The income statement shown below was prepared by Karen Carter, owner of Karens Beauty Supplies. The business

Question:

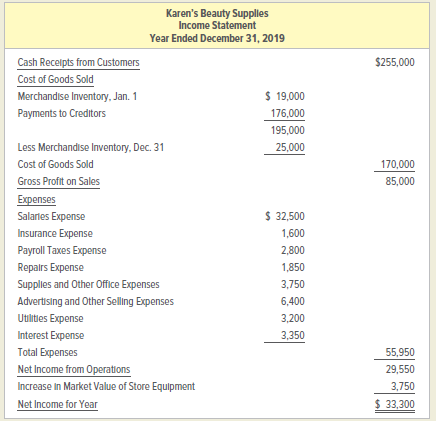

The income statement shown below was prepared by Karen Carter, owner of Karen’s Beauty Supplies. The business is a sole proprietorship that sells skin and hair care products. An accountant who looked at the income statement told Carter that the statement does not conform to generally accepted accounting principles.

INSTRUCTIONS

Prepare an income statement for Karen’s Beauty Supplies in accordance with generally accepted accounting principles.

The following additional information was made available by Carter:

a. On January 1, 2019, accounts receivable from customers totaled $17,500. On December 31, 2019, receivables totaled $15,125.

b. On December 31, 2019, accounts receivable amounting to $1,100 were expected to be uncollectible.

c. On January 1, 2019, accounts payable owed to merchandise suppliers were $11,000. On December 31, 2019, the outstanding accounts payable were $17,855.

d. Included in Salaries Expense is $9,000 that Carter was “paid†for her personal work in the business.

e. Included in Interest Expense is $1,700 that Carter withdrew as interest on her capital investment.

f. Miscellaneous repairs of $750 were charged to Store Equipment during the year. No new equipment was purchased.

g. Carter explains that since the estimated value of her store equipment has increased by $3,750 during the year, no depreciation expense was recorded. The store equipment cost $28,000 and had an estimated useful life of 10 years with estimated salvage value of $2,000.

Analyze: The entries required to correct situations a.–g. would affect several permanent accounts for Karen’s Beauty Supplies. List the permanent accounts affected.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Accounts Payable

Accounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina