The Modern Company builds kitchen cabinets. On January 1, 2019, one job (D42) was in progress. The

Question:

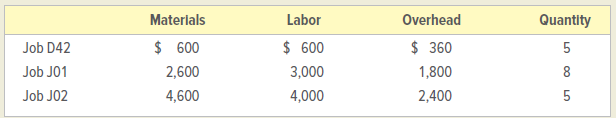

Job J01 is being manufactured for Luxery Cabinets and Job J02 is for stock. Manufacturing overhead is applied at the rate of 60 percent of direct labor costs. During January, actual manufacturing overhead costs of $4,910 were incurred. Job D42 was completed on January 19 and was delivered to the customer. The sales price was $10,000.

INSTRUCTIONS

1. Prepare job order cost sheets for the three jobs. Enter the beginning balances applicable to Job D42.

2. Post the costs of the materials and labor for January to the job order cost sheets.

3. Enter the overhead amounts that should be applied to the three jobs worked on during the month on the job cost sheets.

4. Give the entry in general journal form to transfer the cost of the job completed from work in process to finished goods.

5. Compute the amount of underapplied or overapplied overhead for January. Give the entry in general journal form to transfer your result to Cost of Goods Sold.

Analyze: If The Modern Company sold the five cabinets referenced in Job D42 to Dallas Apartment Corporation for a new total invoice price of $10,350, what gross profit amount was realized on the job? Assume that no overapplication or underapplication of overhead occurred on this job.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina