The Ripcord Parachute Club of Burlington employs three people and pays them on a weekly basis. Payroll

Question:

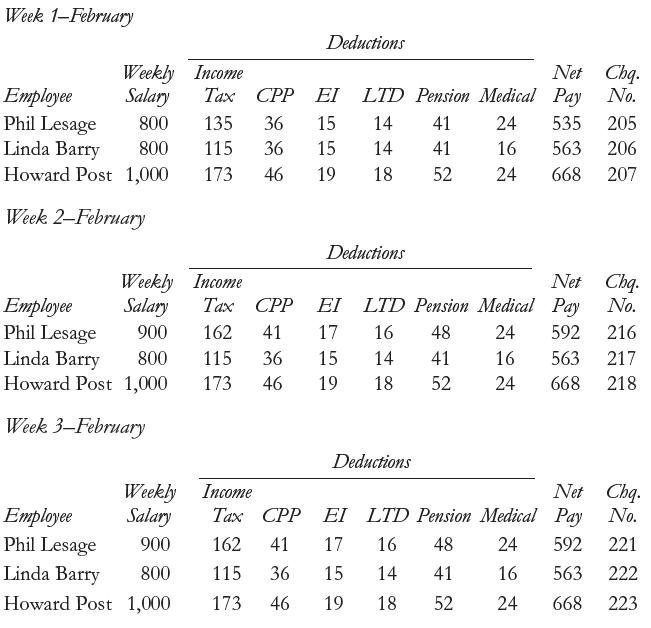

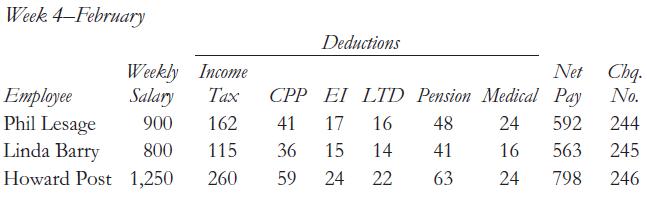

The Ripcord Parachute Club of Burlington employs three people and pays them on a weekly basis. Payroll data for the four weeks in February are shown below:

Assumptions

Employees pay 100% of the cost of long-term disability (LTD). Employees contribute just over 5% of their salary to the pension plan; the employer contributes 6% of the employees’ salary to the plan. Medical cost is split 50/50 by employees and employer. All payroll-related deductions are paid on the 15th of March.

Required

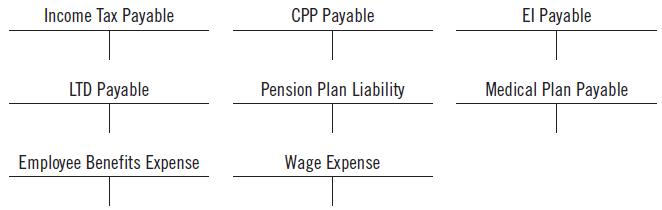

a. While recording in the payroll journal for February, the Ripcord Parachute Club bookkeeper did not record any expense for employee benefits. Give the four journal entries that should be made for the month to record this expense.

b. Post the entries from the payroll journal and the entries in a. to the T accounts shown as follows. (You may ignore the accounts that are not shown.)

c. List the cheques and the amounts of the cheques that will be issued on March 15 for the February payroll.

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 978-0134166698

13th Canadian edition

Authors: Jeffrey Slater, Debra Good