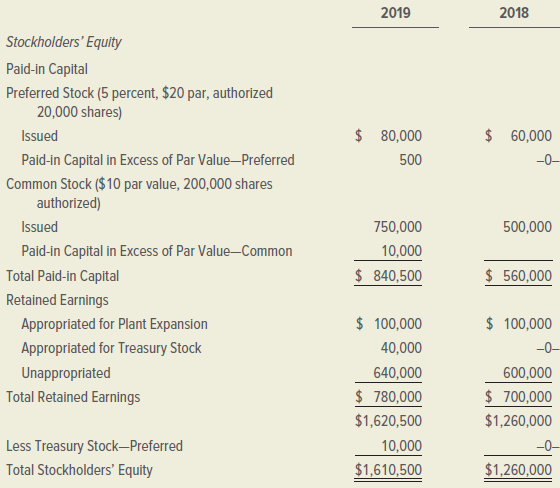

The Stockholders Equity section of the balance sheets for Klee Corporation on December 31, 2018, and December

Question:

a. Additional shares of common stock were issued in April. No other common stock was issued during the year.

b. A cash dividend of $1 per share was declared and paid on common stock in December.

c. The Treasury Stock€”Preferred was purchased at par in January.

d. Additional preferred stock was issued for cash in July.

e. The yearly cash dividend of $1 per share was declared and paid on preferred stock outstanding as of December 3, 2019.

INSTRUCTIONS

Answer the following questions about transactions in 2019:

1. How many shares of preferred stock were outstanding at year-end?

2. How many common stock shares were outstanding at year-end?

3. How many shares of preferred stock were purchased as treasury stock?

4. How many shares of preferred stock were issued for cash?

5. What was the sales price per share of the preferred stock issued?

6. What was the total cash dividend on preferred stock?

7. What was the total cash dividend on common stock?

Analyze: What is the yearly dividend reduction because of the treasury stock purchase?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina

Question Posted: