Question: This practice set will help you review all the key concepts of a merchandise company, along with the integration of payroll, including the preparation of

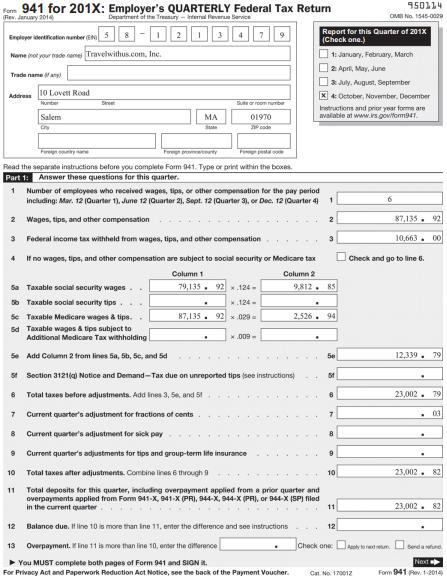

This practice set will help you review all the key concepts of a merchandise company, along with the integration of payroll, including the preparation of Form 941

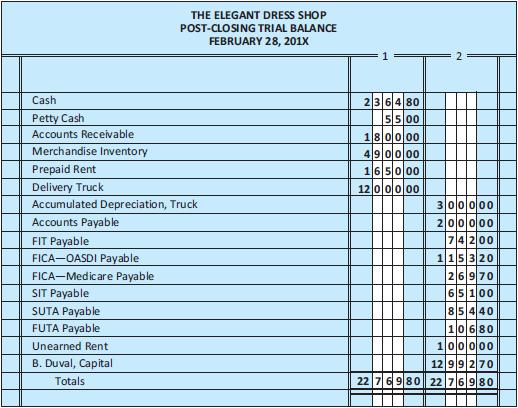

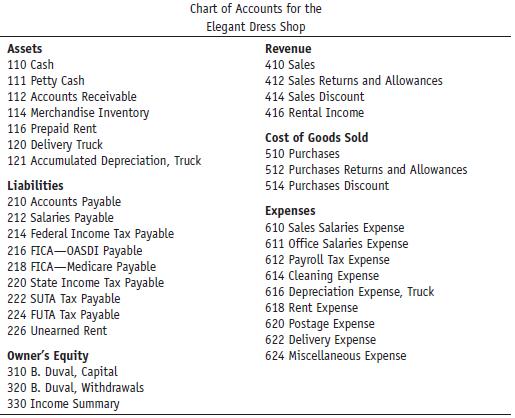

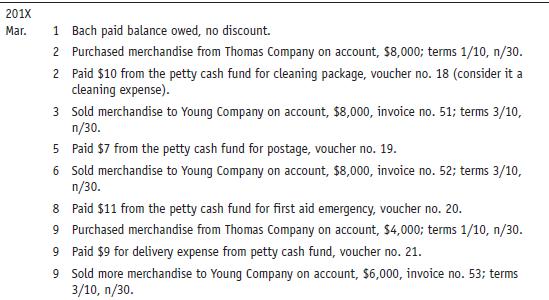

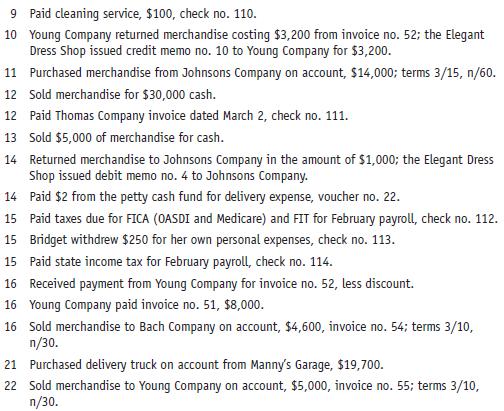

Because you are the bookkeeper for the Elegant Dress Shop, we have gathered the following information for you. It will be your task to complete the accounting cycle for March. The company uses the periodic inventory method.

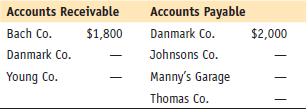

Balances in subsidiary ledgers as of March 1 are as follows:

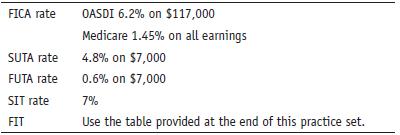

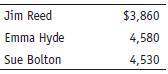

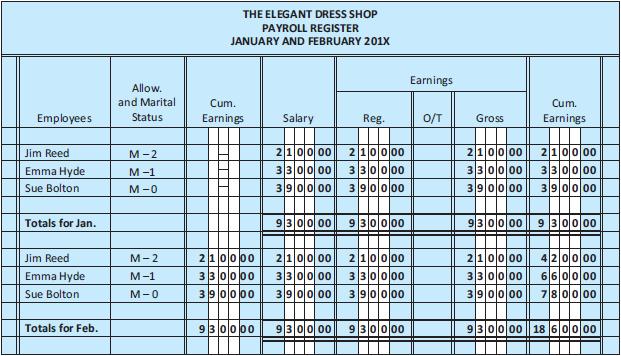

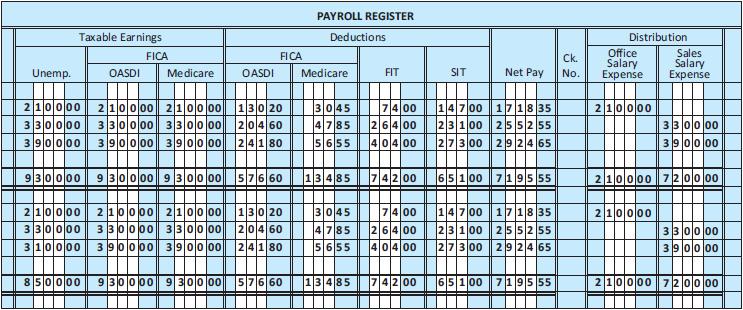

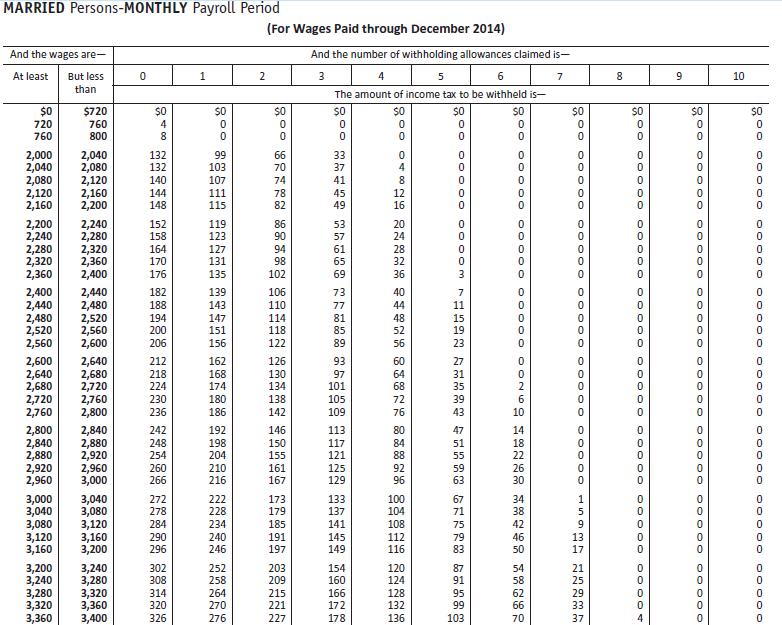

Payroll is paid monthly:

The payroll register for January and February is provided. In March, salaries are as follows:

Your tasks are to do the following:

1. Set up a general ledger, accounts receivable subsidiary ledger, accounts payable subsidiary ledger, auxiliary petty cash record, and payroll register. (Be sure to update ledger accounts based on information given in the post-closing trial balance for February 28 before beginning.)

2. Journalize the transactions, prepare the payroll register, and prepare the auxiliary petty cash record.

3. Update the accounts payable and accounts receivable subsidiary ledgers.

4. Post to the general ledger.

5. Prepare a trial balance on a worksheet and complete the worksheet.

6. Prepare an income statement, statement of owner’s equity, and classified balance sheet.

7. Journalize the adjusting and closing entries.

8. Post the adjusting and closing entries to the ledger.

9. Prepare a post-closing trial balance.

10. Complete Form 941 and sign it for the quarter ending March 31, 201X.

Additional Data

a./b. Ending merchandise inventory, $14,580.

c. During March, rent expired, $550.

d. Truck depreciated, $300.

e. Rental income earned, $250 (one month’s rent from subletting).

f. Bridget Duval’s dress shop is located at 1 Milgate Rd., Marblehead, MA 01945. Its identification number is 33-4158215.

Form 941:

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

To tackle this task well go through each step methodically Step 1 Set up Ledgers and Records 1 General Ledger Start by setting up accounts for the ass... View full answer

Get step-by-step solutions from verified subject matter experts