Question: This Mini Practice Set will help you review all the key concepts of the accounting cycle for a merchandising company, along with the integration of

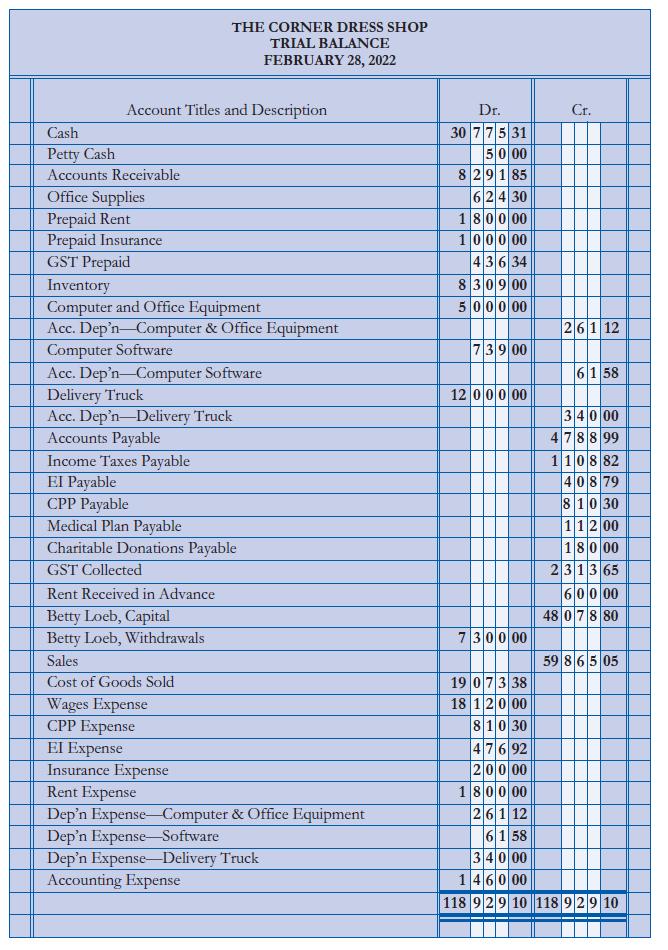

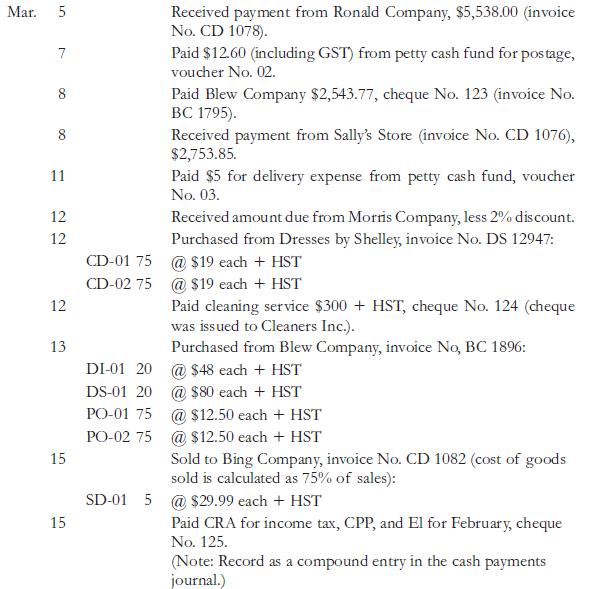

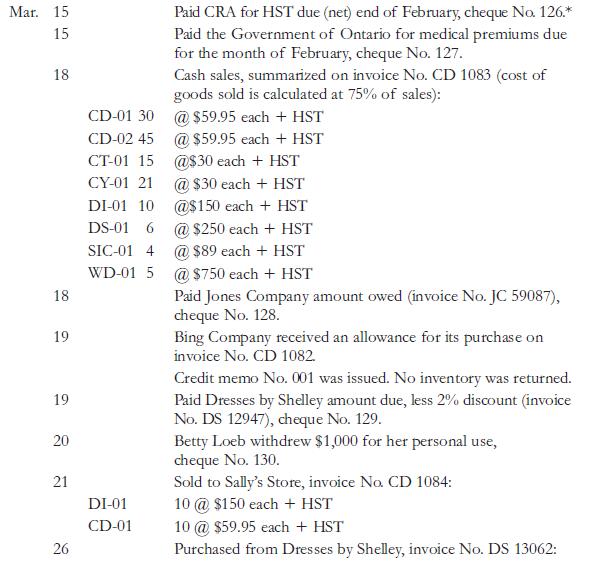

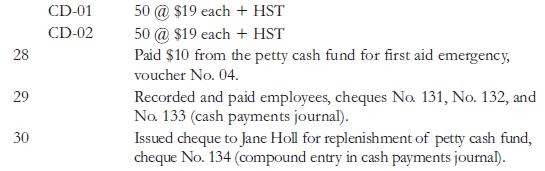

This Mini Practice Set will help you review all the key concepts of the accounting cycle for a merchandising company, along with the integration of payroll. Betty Loeb took over the business now known as The Corner Dress Shop on January 1, 2022. Betty purchased the business name and all assets except cash from her Aunt Marion, who had run it for over ten years. Certain liabilities were assumed by Betty’s new business as part of the deal. You are the bookkeeper of The Corner Dress Shop and have gathered the following information. It is your task to complete the accounting cycle for March 2022.

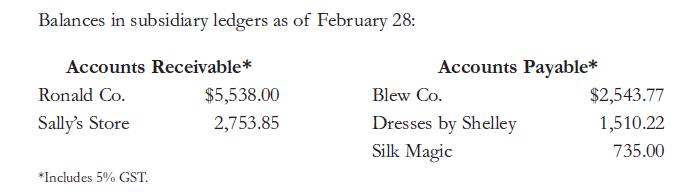

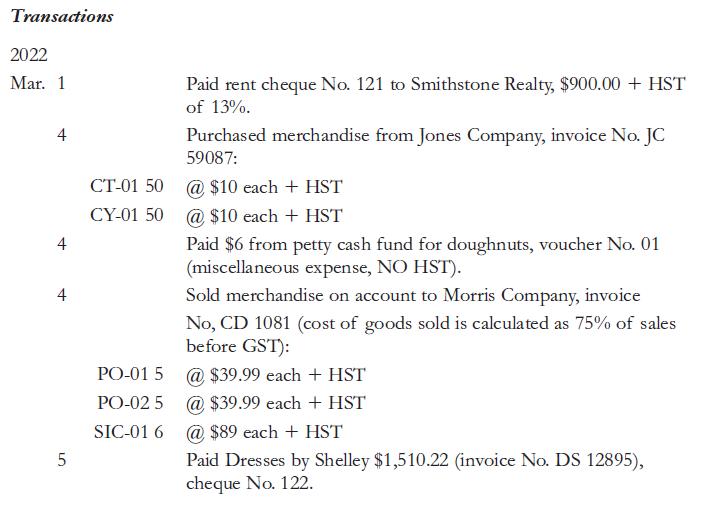

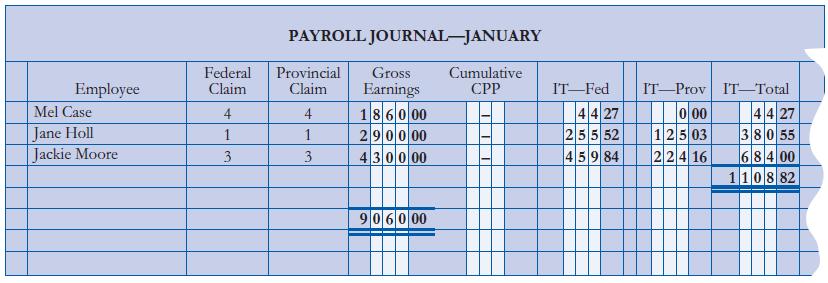

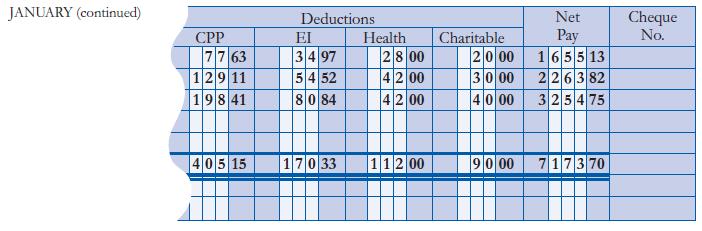

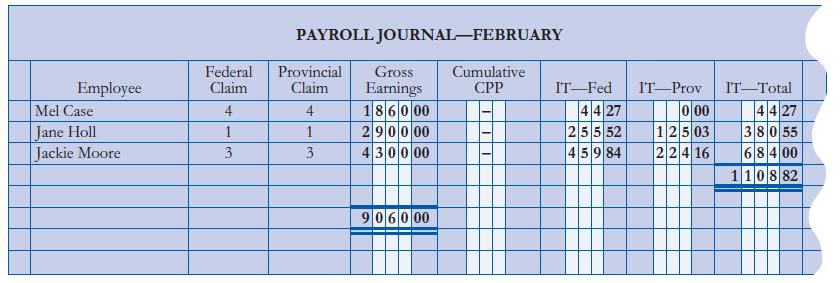

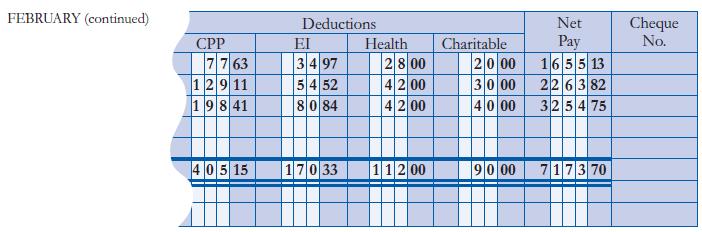

Payroll is paid monthly, and employee claim codes are unchanged. The payroll register for January and February is provided on pages 582–583. In March, salaries are as follows (all deductions are the same unless indicated):

Required

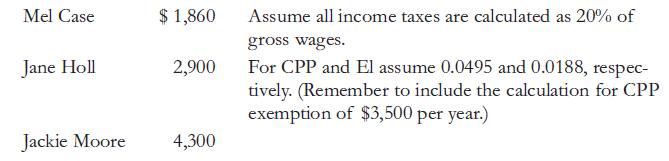

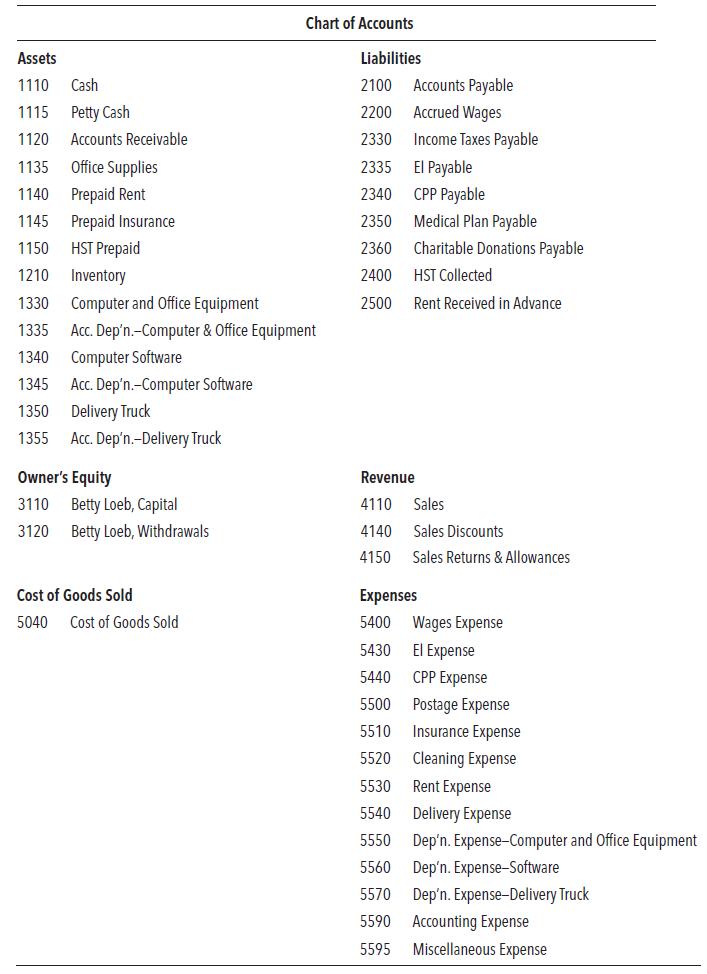

a. Set up a general ledger, accounts receivable ledger, accounts payable ledger, auxiliary petty cash record, and payroll register. (Before beginning, be sure to update the ledger accounts on the basis of information given in the trial balance for February 28.)

b. Journalize all transactions during March, using the special journals discussed in the text. Assume this company uses the perpetual inventory method. The practice set can be completed using either method of accounting for inventory. If no specific method is indicated by your instructor, use the perpetual method. Assume the cost of all inventory is 75% of its selling price.

c. Prepare the payroll register for March.

d. Update the accounts payable and accounts receivable subsidiary ledgers for March.

e. Post to the general ledger.

f. Prepare a trial balance on a worksheet and complete the worksheet as of March 31, 2022.

g. Prepare an income statement, statement of owner’s equity, and classified balance sheet.

h. Journalize the adjusting and closing entries.

i. Post the adjusting and closing entries to the ledger.

j. Prepare a post-closing trial balance.

The chart of accounts for The Corner Dress Shop is provided on the next page.

Additional Data

a. Physical count of merchandise inventory is $6,500.

b. Rental income earned, $300 (one month’s rent from subletting; received in advance in February).

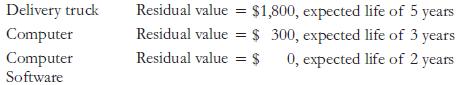

c. Depreciation (straight-line):

d. One month of insurance has expired.

Account Titles and Description Cash Petty Cash Accounts Receivable Office Supplies Prepaid Rent Prepaid Insurance GST Prepaid THE CORNER DRESS SHOP TRIAL BALANCE FEBRUARY 28, 2022 Inventory Computer and Office Equipment Acc. Dep'n-Computer & Office Equipment Computer Software Acc. Dep'n-Computer Software Delivery Truck Acc. Dep'n Delivery Truck Accounts Payable Income Taxes Payable EI Payable CPP Payable Medical Plan Payable Charitable Donations Payable GST Collected Rent Received in Advance Betty Loeb, Capital Betty Loeb, Withdrawals Sales Cost of Goods Sold Wages Expense CPP Expense El Expense Insurance Expense Rent Expense Dep'n Expense Computer & Office Equipment Dep'n Expense-Software Dep'n Expense-Delivery Truck Accounting Expense Dr. 30 775 31 50 00 829185 62430 180000 100000 43634 830900 500000 73900 12 000 00 730000 19 073 38 18 120 00 Cr. 26112 61 58 34000 478899 110882 40879 810 30 11200 18000 231365 600 00 48 07880 598 65 05 81030 47692 20000 180000 26112 6158 34000 146000 118 929 10 118 929 10

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

a b c d e f g h i and j Federal and Provincial Income Taxes combined Date 2022 Mar Mar 15 HST Collec... View full answer

Get step-by-step solutions from verified subject matter experts