You have just contracted to buy a house and will seek financing in the amount of $100,000.

Question:

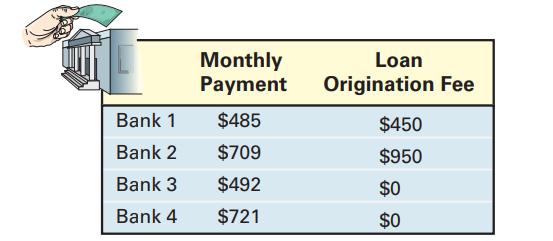

You have just contracted to buy a house and will seek financing in the amount of $100,000. You go to several banks. Bank 1 will lend you $100,000 at the rate of 4.125% amortized over 30 years with a loan origination fee of 0.45%. Bank 2 will lend you $100,000 at the rate of 3.375% amortized over 15 years with a loan origination fee of 0.95%. Bank 3 will lend you $100,000 at the rate of 4.25% amortized over 30 years with no loan origination fee. Bank 4 will lend you $100,000 at the rate of 3.625% amortized over 15 years with no loan origination fee. Which loan would you take? Why? Be sure to have sound reasons for your choice. Use the information in the table to assist you. If the amount of the monthly payment does not matter to you, which loan would you take? Again, have sound reasons for your choice. Compare your final decision with others in the class. Discuss.

Step by Step Answer: