Aloha Properties is located at 4-356 Kuhio Highway, Suite A-1, Kapaa Kauai, HI 96746. Its phone number

Question:

Aloha Properties is located at 4-356 Kuhio Highway, Suite A-1, Kapaa Kauai, HI 96746. Its phone number is 808-823-8375, and the corporation specializes in Hawaii Vacation Rentals. Its federal tax ID number is 72-6914707, and it plans to start using QuickBooks Accountant as its accounting program on January 1, 2014. It has been in business for two years using a manual accounting system.

Aloha hopes that you can help it migrate to QuickBooks Accountant. It is a property rental firm, files Form 1120 each year, and collects a 4% general excise tax

(Tax name: HI Sales Tax, Description: Sales Tax) on all rental income, which must be paid to the State of Hawaii Department of Taxation located at P.O. Box 1425, Honolulu, HI 96806-1425. It has chosen to use sales receipts for its cash sales and invoices and statements for its credit sales. The firm would like to use QuickBooks Accountant to keep track of bills it owes but will continue to handwrite checks. It accepts credit and debit cards.

Aloha plans to use QuickBooks Accountant’s service invoice format but not use progress invoicing. It also plans to use QuickBooks Accountant’s payroll features but to continue calculating payroll manually, because it currently has only two W-2 employees. The firm doesn’t prepare estimates and does not track employee time or segments. It does, however, plan to enter bills as received and then enter payments later. Reports are to be accrual based, and Aloha plans to use the income and expense accounts created in QuickBooks Accountant for a property management company. It will be providing services only, no products. Most of its revenue comes from renting properties located on the island of Kauai to individual and corporate accounts. The company’s policy is to collect a 50% deposit upon reservation and the balance upon arrival. Some customers (those that have prior credit approval) are invoiced upon arrival with the remaining payment due within 30 days. Deposits are recorded as payments on account, even though revenue is not recorded until customers arrive. Other customers (those without prior credit approval) must pay upon arrival, at which time a sales receipt is generated and the remaining payment is collected.

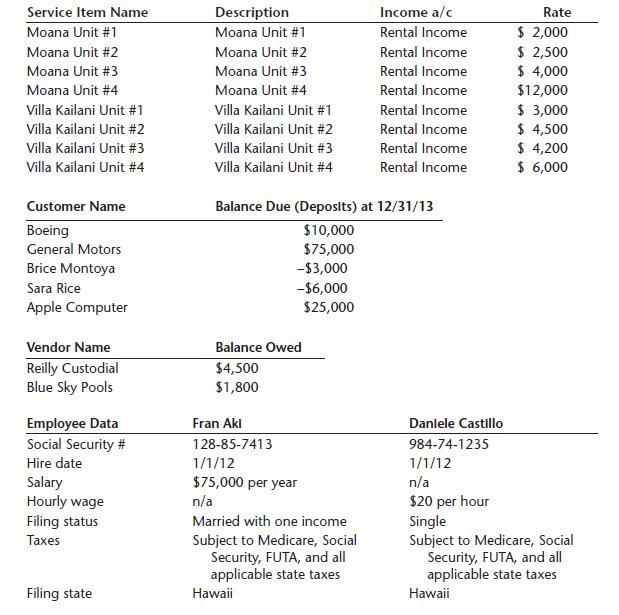

Service items are used, but no inventory is maintained. Existing service items, customers, vendors, and employee information are provided below.

The company owns two properties: Moana located in Princeville and Villa Kailani located in Poipu. As of 12/31/13, it owed \($3,875,000\) (a 25-year mortgage classified as a long-term liability called Notes Payable) on the two properties for which it originally paid \($2,000,000\) and \($3,000,000\) (respectively)

several years ago. Of this amount, \($500,000\) was identified as land, \($250,000\) as furniture and equipment, and \($4,250,000\) as buildings. Use Buildings as the fixed asset account name for the buildings. Accumulated depreciation for all fixed assets as of 12/31/13 was \($1,200,000.

The\) company has one checking account, which had a balance of \($15,000\) on 12/31/13 with the Bank of Hawaii (account name: checking). Its Hawaii withholding, unemployment, and disability identification number is 8432518452. Its unemployment tax rate is 1.9%, and the disability tax rate is 0.01%. Only two payroll items are used: Salary and Hourly. Federal taxes are paid to the U.S. Treasury, and state taxes are paid to the State of Hawaii Department of Taxation quarterly. All employees are paid monthly.

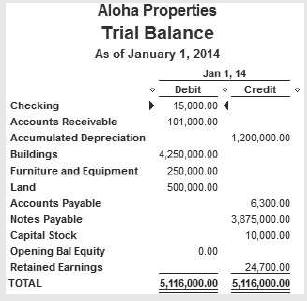

You’ve been asked to reclassify the balance in the Opening Balance Equity account as Capital Stock (\($10,000)\) and Retained Earnings (\($70,000).\) You’ve also been asked to use account names, not numbers, for all accounts.

Use the information provided here to create a new QuickBooks Accountant file for Aloha. (Hint: Read the entire case before you begin, establish the new company file accepting the default name provided, and modify preferences as you did earlier in the chapter. Enter all beginning asset, liability, and equity account balances as of 12/31/13. Use journal entry adjustments to close the Opening Balance Equity account so that there is \($10,000\) in the Capital Stock account and \($24,700\) in the Retained Earnings account. Change account names and delete accounts not used so they match up with the following trial balance.)

After adjustments, the trial balance at 1/1/14 should look like Figure 6.42.

Figure 6.42:

Requirements:

Once you’ve entered all the beginning information, print the following reports as of 1/1/14. (Be sure to keep this QuickBooks Accountant file in a safe place; it will be used as a starting file for this case in Chapter 7.)

1 Customer Balance Summary 2 Vendor Balance Summary 3 Employee Contact List (Employee and SS No. only)

4 Account Listing (Account, Type, and Balance Total only)

5 Item Listing (list only Item, Description, Type, and Price)

6 Trial Balance

Step by Step Answer:

Using QuickBooks Accountant 2018 For Accounting

ISBN: 9780357042083

16th Edition

Authors: Glenn Owen