Restore the file Boston Catering. Do not use the file created in the earlier exercises. Add the

Question:

Restore the file Boston Catering. Do not use the file created in the earlier exercises. Add the following transactions and then print a standard balance sheet as of 7/31/10 and a standard income statement for the month ended 7/31/10.

a. On 7/15/10, the company paid rent to New England Property Management (a new vendor) on check 1503 for $3,000.

b. On 7/29/10, the company paid a bill due Sanford Winery for \($2,000\) on check 1504.

c. During the month of July, Nathan Chambers worked on salary. Kyle Hain worked eight hours a day from the 19th through the 23rd, all of which was unbilled time. He also worked six hours of billable time on Saturday July 24th during the John Hancock summer supper catered event. Use a new service item (X100, Wait Staff, Rate \($25\), Account: Catering Sales, Tax Code:

Nontaxable).

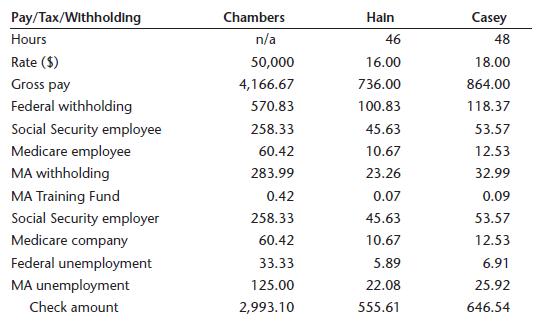

Amy Casey also worked eight hours a day from the 19th through the 23rd, all of which was unbilled time. She also worked 8 hours of billable time on Saturday, July 24th during the John Hancock summer supper catered event. Payroll checks are issued starting with check #1505. Paycheck information is shown below:

d. On 7/31/10, the company recorded sales receipt 931 for John Hancock, terms due on receipt, sales tax applicable, for 175 item S200 and 30 W200 delivered, and 14 hours of wait staff time. On the same date, they received check 12311 from the customer in the amount of \($9,747.50\) as payment in full. Amount was deposited to the bank the same day.

e. On 7/31/10, the company paid \($2,000\) to the US Food Service for food purchased and consumed for the various events in July using check 1508. (Note:

This transaction is in addition to the existing liability to US Food Service.)

f. Change all wine items COGS Account from costs of goods sold to bar purchases.

Step by Step Answer:

Using QuickBooks Accountant 2018 For Accounting

ISBN: 9780357042083

16th Edition

Authors: Glenn Owen