Restore the file Boston Catering. Do not use the file created in the previous exercises. Add the

Question:

Restore the file Boston Catering. Do not use the file created in the previous exercises.

Add the following transactions and then print a standard balance sheet as of 8/31/10 and a standard income statement for the month ended 8/31/10:

a. On 8/6/10, the company contracted with a new customer, Boston College, terms net 15, that is subject to sales tax. The company anticipates many future engagements with this customer and thus created a new job (Event 1).

b. On 8/15/10, the company paid rent to New England Property Management (a new vendor) on check 1513 for $3,000.

c. On 8/16/10, the company contracted with MIT. The company anticipates many future engagements with this customer and thus created a new job (Dean Bumble).

d. On 8/21/10, the company paid all bills outstanding using checks 1514–1516.

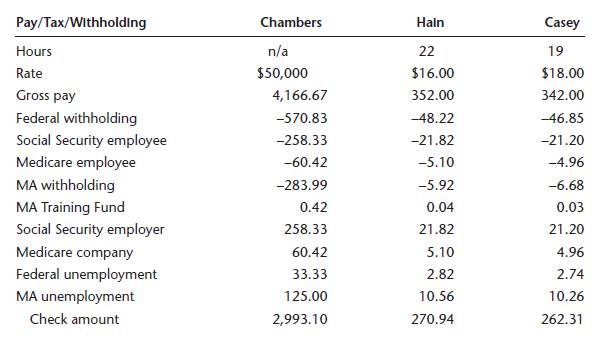

e. During the month of August, Kyle Hain worked 10 hours and Amy Casey worked 9 hours on 8/15 during the Boston College Event 1 party as wait staff. Kyle worked 12 hours and Amy worked 10 hours on 8/29 during the MIT Dean Bumble party as wait staff. Otherwise they did not work. Payroll checks are issued on 8/31/10 starting with check 1517. Paycheck information is shown next.

f. On 8/15/10, the company catered the Boston College Event 1 party. On 8/16/10, the company invoiced Boston College using invoice number 1123. They used 30 bottles of W100 and served 150 heavy appetizers (A100).

g. On 8/29/10, the company catered the MIT Dean Bumble party. On 8/30/10, the company invoiced MIT using invoice number 1124. They used 45 bottles of W201 and served 200 light appetizers (A200).

h. On 8/31/10, the company received a bill from US Food Service for \($800\) in food purchases for the Boston College event. A bill for the MIT party food purchases was expected next month.

i. On 8/31/10, the company paid sales tax due as of 8/31/10 using check 1520.

j. On 8/31/10, the company paid payroll liabilities due as of 7/31/10 using checks 1521 and 1522.

Step by Step Answer:

Using QuickBooks Accountant 2018 For Accounting

ISBN: 9780357042083

16th Edition

Authors: Glenn Owen