Chuck, a dentist, raises prize rabbits for breeding and showing purposes. Assume that the activity is determined

Question:

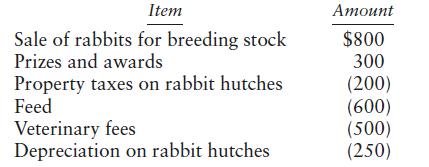

Chuck, a dentist, raises prize rabbits for breeding and showing purposes. Assume that the activity is determined to be a hobby. During the current year, the activity generates the following items of income and expense:

a. What is the total amount of income and deductions Chuck should report for the current year with respect to the rabbit raising activities?

b. Identify which expenses may be deducted and indicate whether they are deductions for or from AGI.

c. By what amount is the cost basis of the rabbit hutches to be reduced for the year?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson

Question Posted: