Dawn started her own rock band on January 2, 2019. She acquired all her equipment on January

Question:

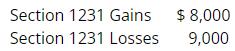

Dawn started her own rock band on January 2, 2019. She acquired all her equipment on January 2, 2019, and did not dispose of any of it before 2021. On April 15, 2021, the band’s amplifier, speakers, and other electronic equipment, are stolen after a concert. The stolen equipment’s basis is $15,000, and its fair market value before the theft is $23,000. The insurance company reimburses Dawn $23,000. Her road bus runs off the highway on September 13, 2021. The basis of the bus is $60,000. Its fair market value before the accident is $80,000, and the fair market value after the accident is $70,000. The insurance company reimburses Dawn $4,000 for the bus accident. Dawn’s other gains and losses during 2021 are:

What is the effect of these transactions on Dawn’s 2021 taxable income? Explain and show your calculations.

What is the effect of these transactions on Dawn’s 2021 taxable income? Explain and show your calculations.

Step by Step Answer:

Concepts In Federal Taxation 2022

ISBN: 9780357515785

29th Edition

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher