During 2023, Pam incurred the following casualty losses: All of the items were destroyed in the same

Question:

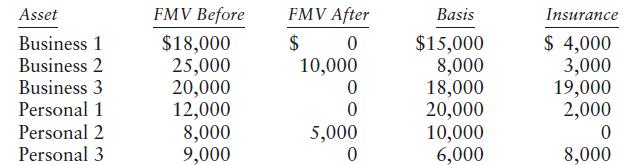

During 2023, Pam incurred the following casualty losses:

All of the items were destroyed in the same casualty, which resulted from a federally declared disaster. Before considering the casualty items, Pam reports business income of \($80,000,\) qualified residential interest of \($6,000\) property taxes on her personal residence of \($2,000,\) and charitable contributions of \($4,000.\) Compute Pam’s taxable income for 2023. Pam is single.

Transcribed Image Text:

Asset FMV Before FMV After Basis Insurance Business 1 $18,000 $ 0 $15,000 $ 4,000 Business 2 25,000 10,000 8,000 3,000 Business 3 20,000 0 18,000 19,000 Personal 1 12,000 0 20,000 2,000 Personal 2 8,000 5,000 10,000 0 Personal 3 9,000 0 6,000 8,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson

Question Posted:

Students also viewed these Business questions

-

During 2015, Pam incurred the following casualty losses: All of the items were destroyed in the same casualty. Before considering the casualty items, Pam reports business income of $80,000, qualified...

-

During 2013, Pam incurred the following casualty losses: All of the items were destroyed in the same casualty. Before considering the casualty items, Pam reports business income of $80,000, qualified...

-

During 2017, Pam incurred the following casualty losses: All of the items were destroyed in the same casualty. Before considering the casualty items,Pam reports business income of $80,000, qualified...

-

According to a study performed by the NCAA, the average rate of injuries occurring in collegiate womens soccer is 8.6 per 1000 participants (www.fastsports.com/tips/tip12/). a. Using the Poisson...

-

Can a person's religious beliefs be proven wrong? Can a person's understanding of a particular scientific concept be proven wrong?

-

For each of the following pairs of compounds, determine which compound is more stable (you may find it helpful to draw out the chair conformations): (a) (b) (c) (d) II

-

A \(15-\mathrm{kg}\) box is pushed at \(5 \mathrm{~m} / \mathrm{s}\) across a low-friction floor and is caught by a \(60-\mathrm{kg}\) man on low-friction skates, initially at rest. What is the...

-

Lark Corporation is considering the acquisition of an asset for use in its business over the next five years. However, Lark must decide whether it would be better served by leasing the asset or...

-

n 1 1. lim tantan is equal to 004-1 1+r+r2 2. 3. If the least and the largest real values of a, for which the equation z + a |2-1+21=0(z=C and i=1) has a solution, are p and q respectively, then 4(p...

-

During 2022, Becky loans her brother Ken \($5,000,\) which he intends to use to establish a small business. Because Ken has no other assets and needs cash to establish the business, the agreement...

-

Jerry sprayed all of the landscaping around his business with a pesticide in June 2023. Shortly thereafter, all of the trees and shrubs unaccountably died. The FMV and the adjusted basis of the...

-

The noise equivalent bandwidth of a band pass signal is defined as the value of band width that satisfies the relation 2BS (fc) = P/2 where 2B is the noise equivalent bandwidth centered around the...

-

A companys bonds have 15 years to maturity, a 7.6% coupon rate paid semi-annually, and a $1,000 par value. The bonds have a 7% nominal yield to maturity, but can be called in 6 years at a price of...

-

HOW Student has good financial skills to manage the businesses budgets and finances. Explain briefly to help students.

-

The balance sheet of Computer World reports total assets of $350,000 and $450,000 at the beginning and end of the year, respectively. Sales revenues are $800,000, net income is $100,000, and net cash...

-

On 3 July 2014 Simon sold half of his shares in ABC Ltd for $12 a share plus $90 brokerage. He had originally acquired 2,000 shares in ABC Ltd on 2 September 1986 at a price of $5 a share plus $80...

-

Give your answers rounded to 6 decimal places in the following questions. 1. The effective rate of interest is 6.5% per annum. Calculate the effective rate of interest per month. 2. The effective...

-

A rigid storage tank of 1.5 m3 contains 1 kg argon at 30C. Heat is then transferred to the argon from a furnace operating at 1300C until the specific entropy of the argon has increased by 0.343 kJ/kg...

-

Feller Company purchased a site for a limestone quarry for $100,000 on January 2, 2019. It estimate that the quarry will yield 400,000 tons of limestone. It estimates that its retirement obligation...

-

A rumor is spread about you at your place of work that is irrelevant to your ability to perform at the company but reveals personal information that you would rather not share at work. You cannot...

-

Comment critically on the nature and value of the investigation. What difficulties does such an investigation present and how might these difficulties be best overcome? State clearly the conclusions...

-

Sue is selling her house for $265,000. Closing is set for June 19, and Sue owns the day of closing. She has a loan balance of $78,000 at a 4.2% rate, and she's current on her payments. She prepaid...

Study smarter with the SolutionInn App