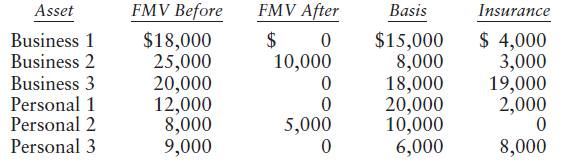

During 2017, Pam incurred the following casualty losses: All of the items were destroyed in the same

Question:

Transcribed Image Text:

FMV After Basis Insurance FMV Before Asset Business 1 Business 2 Business 3 Personal 1 $18,000 25,000 20,000 12,000 8,000 9,000 $15,000 8,000 18,000 20,000 10,000 6,000 $ 4,000 3,000 19,000 2,000 10,000 Personal 2 Personal 3 5,000 8,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

Since the losses on the business property exceed the gains they are all ordinary losses for AGIThus ...View the full answer

Answered By

Mustafa olang

Please accept my enthusiastic application to solutionInn. I would love the opportunity to be a hardworking, passionate member of your tutoring program. As soon as I read the description of the program, I knew I was a well-qualified candidate for the position.

I have extensive tutoring experience in a variety of fields. I have tutored in English as well as Calculus. I have helped students learn to analyze literature, write essays, understand historical events, and graph parabolas. Your program requires that tutors be able to assist students in multiple subjects, and my experience would allow me to do just that.

You also state in your job posting that you require tutors that can work with students of all ages. As a summer camp counselor, I have experience working with preschool and kindergarten-age students. I have also tutored middle school students in reading, as well as college and high school students. Through these tutoring and counseling positions, I have learned how to best teach each age group. For example, I created songs to teach my three-year-old campers the camp rules, but I gave my college student daily quizzes to help her prepare for exams.

I am passionate about helping students improve in all academic subjects. I still remember my excitement when my calculus student received her first “A” on a quiz! I am confident that my passion and experience are the qualities you are looking for at solutionInn. Thank you so much for your time and consideration.

4.80+

2+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

During 2015, Pam incurred the following casualty losses: All of the items were destroyed in the same casualty. Before considering the casualty items, Pam reports business income of $80,000, qualified...

-

During 2016, Pam incurred the following casualty losses: All of the items were destroyed in the same casualty. Before considering the casualty items, Pam reports business income of $80,000, qualified...

-

During 2013, Pam incurred the following casualty losses: All of the items were destroyed in the same casualty. Before considering the casualty items, Pam reports business income of $80,000, qualified...

-

SharpCo operates a large grocery store. On 1 October 2022, SharpCo purchased and installed a new security system at a cost of $200,000 (excluding GST) with an effective life of 10 years, SharpCo does...

-

Briefly describe how the Internet phone service operates. Discuss the potential impact that this service could have on traditional telephone services and carriers.

-

Record the following transactions for the month of January of a small finishing retailer, balance-off all the accounts, and then extract a trial balance as at 31 January 2012. 2012 Jan 1 Started in...

-

The data in Table 2.9 is due to Anscombe (1973). The purpose of this exercise is to demonstrate how plotting data can reveal important information that is not evident in numerical summary statistics....

-

A list of selected items involving Fischer Companys cash flow activities for 2016 is presented here: a. Patent amortization expense, $3,500 b. Machinery was purchased for $ 39,500 c. At year-end,...

-

A new salt factory is being developed at a remote location in salt affected region of Victoria. This factory does not have access to utilities such as grid electricity, piped gas and town water...

-

This case study on project evaluation is applicable for beginning courses in corporate finance or finance strategy. Two alternative investment options are available to evaluate. Challenges are...

-

Jerry sprayed all of the landscaping around his house with a pesticide in June 2017. Shortly thereafter, all of the trees and shrubs unaccountably died. The FMV and the adjusted basis of the plants...

-

During 2016, Becky loans her brother Ken $5,000, which he intends to use to establish a small business. Because Ken has no other assets and needs cash to establish the business, the agreement...

-

From Figure 20-2 estimate the rate of reaction at (a) t = 800 s; (b) The time at which [H 2 O 2 ] = 0.50 M. Figure 20-2 [HO], mol/L 2.50- 2.00- 1.50 1.00 0.50- 1 400 1 800 1 1200 1600 Time, s 2000...

-

Rephrase. I am a new member at FWA, and member of the ME committee. The president-elect Albana Theka has forwarded our committee your email with regard to the Financial Literacy workshop. I would...

-

Samantha Dickerson is the manager for the cardiac department at Jefferson Medical Center. Every year she must figure out operating expenses for equipment and salaries for the cardiac department's...

-

When a customer returns merchandise and the retailer agrees to give a full refund, a. Sales is debited for the amount of the sale excluding the sales tax. b. Sales Returns and Allowances is debited...

-

Match the financial term with its proper definition. Question 35 options: A) Budget itemized forecasts of a company's income, expenses, and capital needs B) Financial ratios written report that...

-

Under employment, an employee may not receive severance pay if employment is terminated but severance pay is received if contract is terminated by independent contractor. Question 7 options: True...

-

Determine whether the three points are collinear. (-1, -3), (-5, 12), (1, -11)

-

Find the APR in each of the following cases: NUMBER OF TIMES COMPOUNDED Semiannually Monthly Weekly Infinite EAR APR 10.4% 8.9 11.6 15.4

-

What minimum level of stock ownership does the IRC require for a corporation to be included in an affiliated group?

-

Define the following terms: a. Intercompany transaction. b. Intercompany item. c. Corresponding item. d. Recomputed corresponding item. e. Matching rule. f. Acceleration rule.

-

P and S1 Corporations have filed consolidated tax returns for several years. S1 acquires all of S2 Corporations stock at the close of business on June 15 of the current year. Which of the following...

-

What is a data flow diagram? Why do systems analysts use data flow diagrams? How can data flow diagrams be used as analysis tools? How do you decide if a system component should be represented as a...

-

Suppose the demand and supply functions are as given below: Qa86 0.8 P Q-10+ 0.2 P Find the equilibrium price and quantity and show it graphically.

-

1. How much will an investment of Php 17,000 be if it is compounded quarterly for six (6) years at 5% interest? 2. If an interest of Php 5,000 is deposited into a savings account at an interest rate...

Study smarter with the SolutionInn App