Question:

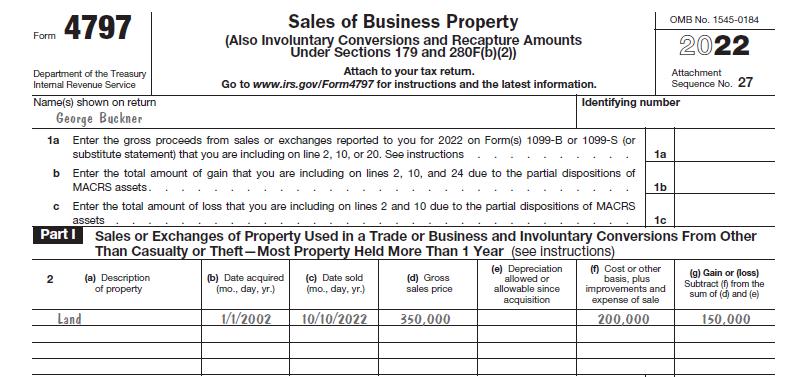

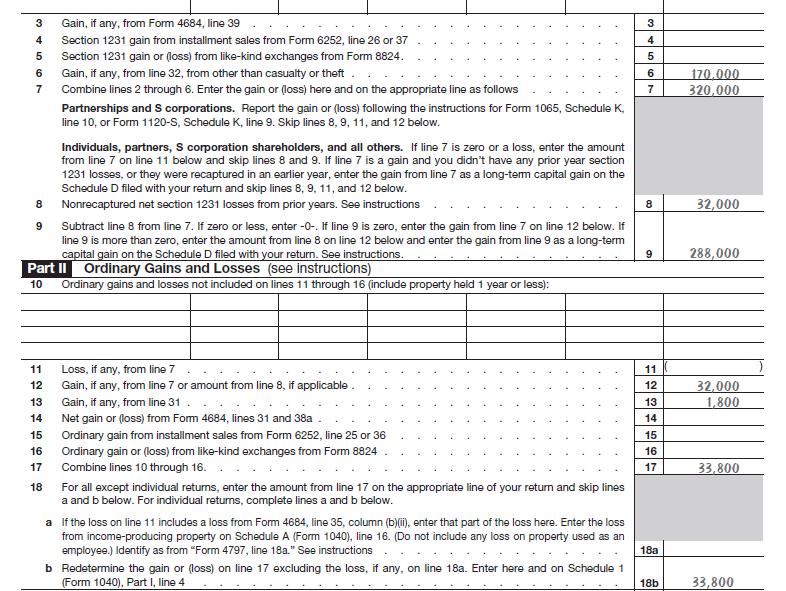

George Buckner sells an apartment building on October 10 for \($1.75\) million. The building was purchased on January 1, 2002, for \($2\) million.

Depreciation of \($420,000\) has been taken. The figures given above do not include the purchase price or the selling price of the land. Mr. Buckner’s adjusted basis for the land is \($200,000,\) and the sales price is \($350,000.\) Mr. Buckner, who owns and operates a taxi business, sells one of the automobiles for \($1,800\) on November 14th. The automobile’s adjusted basis is zero, and the original cost is \($15,000.\) The automobile was purchased on April 25, 2013. Mr. Buckner has no other gains and losses during the year, and non recaptured net Sec. 1231 losses amount to \($32,000.\) Prepare Form 4797.

Data From Form 4797

Transcribed Image Text:

Form 4797 Department of the Treasury Internal Revenue Service Name(s) shown on return George Buckner Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return. Go to www.irs.gov/Form4797 for instructions and the latest information. OMB No. 1545-0184 2022 Attachment Sequence No. 27 Identifying number 1a Enter the gross proceeds from sales or exchanges reported to you for 2022 on Form(s) 1099-B or 1099-S (or substitute statement) that you are including on line 2, 10, or 20. See instructions. b Enter the total amount of gain that you are including on lines 2, 10, and 24 due to the partial dispositions of MACRS assets. c Enter the total amount of loss that you are including on lines 2 and 10 due to the partial dispositions of MACRS assets 1a 1b 1c Part I Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft-Most Property Held More Than 1 Year (see instructions) 2 (a) Description of property Land (b) Date acquired (mo., day, yr.) 1/1/2002 (c) Date sold (mo., day, yr.) 10/10/2022 (d) Gross sales price 350,000 (e) Depreciation allowed or allowable since acquisition (f) Cost or other basis, plus improvements and expense of sale 200,000 (g) Gain or (loss) Subtract (f) from the sum of (d) and (e) 150,000