Jim Sarowski (SSN 000-00-2222) is 70 years old and single. He received Social Security benefits of ($16,000.)

Question:

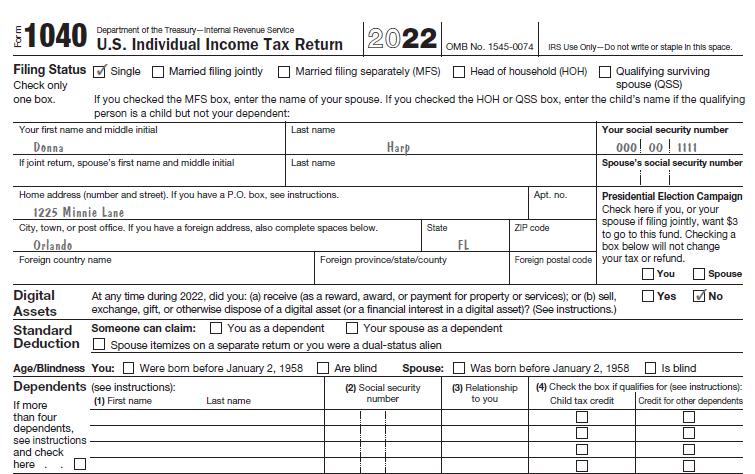

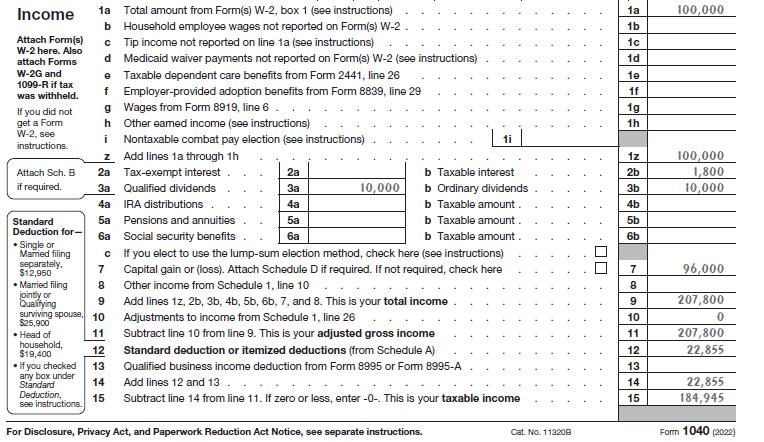

Jim Sarowski (SSN 000-00-2222) is 70 years old and single. He received Social Security benefits of \($16,000.\) He works part-time as a greeter at a local discount store and received wages of \($7,300.\) Federal income taxes of \($250\) were withheld from his salary. Jim lives at Rt. 7 in Daingerfield, Texas, and he had no transactions involving virtual currency during the year.

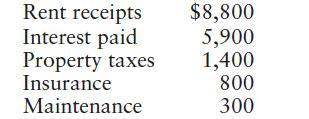

In March of 2022, he purchased a duplex at 2006 Tennessee Street to use as rental property for \($100,000,\) with 20% of the price allocated to land. During the year, he had the following receipts and expenditures with respect to the duplex:

Other expenditures during the year:

On July 24, he exchanged ten acres of land for a car with a \($16,500\) FMV to be held for personal use. The land was purchased on November 22, 1995, for \($18,000\) as an investment.

Because of pollution problems in the area, the value of the land declined.

On December 1, he sold his residence, which had been his home for 30 years, for \($475,000.\) Sales commissions of \($16,000\) were paid, and the adjusted basis for his home is \($110,000.\) He plans to rent an apartment and does not plan to purchase another home.

His only other sale of a principal residence occurred 32 years ago.

a. Determine the amount of recognized gain on the sale of the residence.

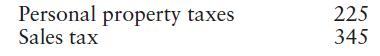

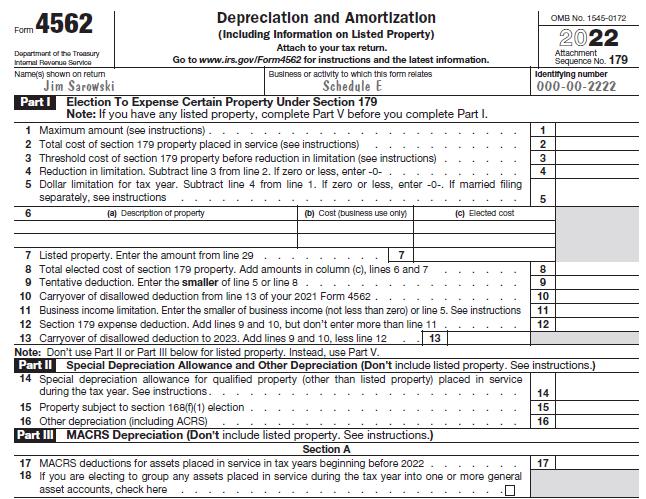

b. Prepare Forms 4562 and 1040, including Schedules D and E.

Data From Form 4562

Data From Form 1040

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson