Mario owns his own business and drives his car 15,000 miles a year for business and 7,500

Question:

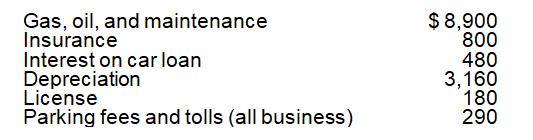

Mario owns his own business and drives his car 15,000 miles a year for business and 7,500 miles a year for commuting and personal use. He wants to claim the largest tax deduction possible for business use of his car. His total auto expenses for 2018 are as follows:

a. What is Mario's 2018 deduction using the standard mileage rate?

b. What is Mario's 2018 deduction using the actual cost method?

Transcribed Image Text:

Gas, oil, and maintenance Insurance Interest on car loan Depreciation License Parking fees and tolls (all business) $ 8,900 800 480 3,160 180 290

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

a Under the standard mileage rate method Mario can deduct 8465 He can deduct 545 cents for each mile ...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Concepts In Federal Taxation

ISBN: 9781337702621

26th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted:

Students also viewed these Business questions

-

Mario owns his own business and drives his car 15,000 miles a year for business and 7,500 miles a year for commuting and personal use. He wants to claim the largest tax deduction possible for...

-

Mario owns his own business and drives his car 15,000 miles a year for business and 7,500 miles a year for commuting and personal use. He wants to claim the largest tax deduction possible for...

-

Mario owns his own business and drives his car 15,000 miles a year for business and 7,500 miles a year for commuting and personal use. He wants to claim the largest tax deduction possible for...

-

Why is it likely to have preexisting normal faults in an orogenic belt?

-

Firm X can produce a necessary component in-house at a cost of 10 or purchase it from one of three suppliers (A, B, or C) whose costs are 8, 7, and 5, respectively. X can approach the firms in any...

-

Calculate the NPV of the hybrid model, using the annual fuel savings as the annual cash inflow for the 10 years you would own the car.

-

Is the development life cycle over with deployment?

-

Presented below is an aging schedule for Bryan Company. At December 31, 2016, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $8,000. Instructions (a) Journalize and post the...

-

Seidner Company had the following account balances at the end of the first year of operations: Revenues $102,000 Salaries Expense $18,000 Dividends $13,000 Utilities Expense $12,000 Advertising...

-

[5] A marksman is firing a pistol at a 5 cm diameter, circular bullseye some distance away. The center of the target is considered (0, 0). This marksman pulls a little to the right (positive x) and a...

-

In addition to being an employee of Rock Hard Roofing Material, Lou owns 10% of the company's common stock. Rock Hard falls on hard times in 2017. To forestall bankruptcy, Rock Hard's employees and...

-

Karl is the vice president of finance for Wyatt Industries. In 2018, he met a client at an afternoon baseball game. The box-seat tickets cost $30 each. Because the client had a plane flight after the...

-

An analyst at a local bank wonders if the age distribution of customers coming for service at his branch in town is the same as at the branch located near the mall. He selects 100 transactions at...

-

How can leaders leverage technology and digital tools to streamline the delegation process, facilitating real-time monitoring, progress tracking, and performance evaluation, while also promoting...

-

In the following situation, what should the monopolist do to maximize profit? A monopolist is currently producing a level of output such that marginal revenue is $136 and marginal cost is $85. The...

-

What measures can leaders implement to mitigate potential risks and challenges associated with delegation, such as task ambiguity, resource constraints, or competency gaps, proactively identifying...

-

What strategies and frameworks can leaders employ to effectively delegate tasks and responsibilities, taking into account factors such as team member competencies, workload distribution, and risk...

-

Determine whether the function has an inverse function. f(x)=(x+2)2, x-2 Yes, f does have an inverse. O No, f does not have an inverse. If it does, then find the inverse function. (If an answer does...

-

Why is a randomized trial the gold standard for solving the identification problem?

-

Repeat the previous problem, but close the positions on September 20. Use the spreadsheet to find the profits for the possible stock prices on September 20. Generate a graph and use it to identify...

-

Determine whether each of the following taxpayers must file a return in 2016: a. Felicia is a dependent who has wages of $6,100 and interest income of $225. b. Jason is a dependent who has interest...

-

Jacqueline is single. In June 2016, she receives a refund of $250 from her 2015 state tax return. Her 2015 itemized deductions were $8,000. In October 2016, her 2014 state tax return is audited, and...

-

Troy's 2014 tax return is audited. The auditor determines that Troy inadvertently understated his ending inventory in calculating his business income. The error creates an additional tax liability of...

-

1. Multiply the matrix 5-1 3 4 7 -2 0 6) by each of the following vectors or state "not defined." 6 a. b. 3 2 2. For a homomorphism from the set if second degree or less polynomials to the set of...

-

Use lattice multiplication to find the product. 33 x 78 3 3 2 2 A D B C 4 4 3378 = Use pencil and paper to create the lattice. Then give the values for A, B, C, and D and fill in the missing entries....

-

A single 1-oz serving of tortilla chips contains 260.0 mg of sodium. If an individual ate the entire 15-oz bag, how many grams of sodium would he ingest? If the recommended daily intake of sodium is...

Study smarter with the SolutionInn App