On June 2, 2021, Lokar Corporation purchases a patent for $68,000 from the inventor of a new

Question:

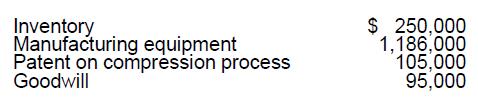

On June 2, 2021, Lokar Corporation purchases a patent for $68,000 from the inventor of a new extrusion process. The patent has 12 years remaining on its legal life. Also, Lokar purchases substantially all of the assets of Barrios Corporation for $750,000 on September 8, 2021. The values of the assets listed in the purchase agreement are as follows:

Determine the maximum 2021 cost-recovery deductions for the assets purchased.

Transcribed Image Text:

Inventory Manufacturing equipment Patent on compression process Goodwill $250,000 1,186.000 105.000 95,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

Intangible assets purchased in connection with the acquisition of a ...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Concepts In Federal Taxation 2022

ISBN: 9780357515785

29th Edition

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher

Question Posted:

Students also viewed these Business questions

-

On June 2, 2020, Lokar Corporation purchases a patent for $68,000 from the inventor of a new extrusion process. The patent has 12 years remaining on its legal life. Also, Lokar purchases...

-

On June 2, 2015, Lokar Corporation purchases a patent for $68,000 from the inventor of a new extrusion process. The patent has 12 years remaining on its legal life. Also, Lokar purchases...

-

On June 2, 2011, Lokar Corporation purchases a patent for $68,000 from the inventor of a new extrusion process. The patent has 12 years remaining on its legal life. Also, Lokar purchases...

-

Mary is 30 years old and married to Mark, age 36. Mark passed away on January 30, 2021. Mark was unemployed and had no income in 2021 due to his illness. Marys seven-year-old daughter, Jenny, lived...

-

Distinguish between qualitative and quantitative decision analyses.

-

Jamison Corporation issued $100,000, 8%, 10-year bonds on January 1, 2012, when the market rate of interest was 10%. Proceeds were $87,710.87. Interest is payable annually on January 1. Jamison uses...

-

Visualizing Football and Brain Size Exercise 2.143 introduces a study in which the number of years playing football and the size of the hippocampus in the brain were recorded for each person in the...

-

The units of an item available for sale during the year were as follows: There are 36 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the...

-

How do Agile scaling frameworks such as SAFe (Scaled Agile Framework) and LeSS (Large-Scale Scrum) address the complexities of coordinating multiple Agile teams within large enterprises, while...

-

Overview The milestone for Project One involves applying accounting principles and methods to long-term liabilities and equity. You will also evaluate these financial statement components for...

-

On May 15, 2021, Lurlene buys a used automobile for $20,000. She drives it, 9,000 miles for business and 3,000 miles for personal trips during the year. What is Lurlenes maximum cost recovery for...

-

On June 1, 2021, Kirsten buys an automobile for $60,000. Her mileage log for the year reveals the following: 20,000 miles for business purposes; 7,000 miles for personal reasons; and 3,000 miles...

-

Two loudspeakers on a concert stage are vibrating in phase. A listener is 50.5 m from the left speaker and 26.0 m from the right one. The listener can respond to all frequencies from 20 to 20 000 Hz,...

-

Prepare an income statement for Rex Manufacturing for the year ended December 31 using the following information. Hint. Not all information given is needed for the solution. Finished goods inventory,...

-

How do individuals cultivate psychological resilience in the face of adversity, drawing upon cognitive restructuring and emotion regulation techniques?

-

Baker Company produced 1,750 units in May at a total cost of $10,500 and 4,450 units in June at a total cost of $20,220. Compute the variable cost per unit and the total fixed cost using the high-low...

-

What implications do emerging findings in epigenetics and gene-environment interactions hold for understanding the biological underpinnings of resilience, and how can this knowledge inform...

-

On March 1, 2023, VisionTech Inc.'s board of directors declared a 15% share dividend when the market price per share was $8.00. On November 15, 2023, the board of directors declared a 4:1 share...

-

Refer to Table 13-2 in Section 13-1 and identify the efficiency of the Kruskal Wallis test. What does that value tell us about the test? Table 13-2 Efficiency: Comparison of Parametric and...

-

Do animals have rights? If so, what are they? What duties do human beings have toward animals? Does KFC protect animal welfare at an acceptable level?

-

Most expenditures that have a business purpose and meet the ordinary, necessary, and reasonable requirements are deductible. However, specific rules must be adhered to in determining the...

-

What requirements must be met for meal and entertainment expenses to be deductible?

-

How does an entertainment expense directly related to business differ from an entertainment expense associated with business?

-

FIBK paid an annual dividend of $1.33 this past year, and has announced that the dividend for the current year will be $1.36. The stock has a Beta of 1.16, the risk-free rate is 2.5%, and the equity...

-

1) Determine the average range of the projectile. Launch the projectile 10 times at a fixed firing angle of 30 degrees. Measure the range of the projectile each time and record the results in the...

-

Your company has the debt-to-equity breakdown below. The cost of the equity is 5%, and the cost of the debt is 15%. The tax rate is 20%. Cost of Capital Proportion of Total Assets Equity 10% 40% Debt...

Study smarter with the SolutionInn App