Ken and Helen own a bed and breakfast in Vermont. They acquired the property in 2005 for

Question:

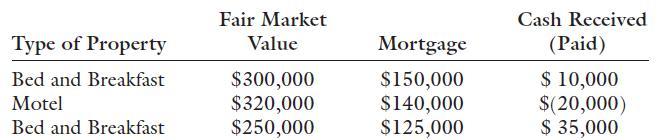

Ken and Helen own a bed and breakfast in Vermont. They acquired the property in 2005 for $190,000, and their adjusted basis in it is $95,000. The property is worth $260,000, and they have a mortgage of $100,000. Both are tired of the cold winters and eventually would like to retire in the Southwestern United States. However, Ken and Helen feel that they need to work another 7 or 8 years first. A friend has suggested that they could move now if they can find another bed and breakfast or a small motel in the Southwest and do a like-kind exchange. However, their friend warns them: “If you do a like-kind exchange, you better get some tax help and don’t make the same mistake I made.” After consulting with a regional real estate firm, they find three properties that they are interested in pursuing. Before they go to the expense of visiting the properties, Ken and Helen have come to you for tax advice. They tell you that any cash needed to acquire the new property would come from the sale of stock. The long-term capital gain on the sale would be 70 percent of the sale proceeds. They are in the 32 percent marginal tax bracket. Using the information on the three properties below, determine which property will minimize the tax consequences of the exchange.

Step by Step Answer:

Concepts In Federal Taxation 2021

ISBN: 9780357141212

28th Edition

Authors: Kevin E. Murphy, Mark Higgins, Randy Skalberg